MISSISSIPPI INSURANCE DEPARTMENT

Report of Examination

of

AMERICAN FEDERATED LIFE

INSURANCE COMPANY

as of

December 31, 2019

TABLE OF CONTENTS

Examiner’s Affidavit ............................................................................................................................... 1

Salutation ................................................................................................................................................. 2

Scope of Examination .............................................................................................................................. 3

Comments and Recommendations of Previous Examination .................................................................. 3

History of the Company ........................................................................................................................... 3

Corporate Records ................................................................................................................................... 4

Management and Control ......................................................................................................................... 4

Stockholder ................................................................................................................................. 4

Board of Directors ...................................................................................................................... 4

Officers ....................................................................................................................................... 4

Conflict of Interest ...................................................................................................................... 5

Holding Company Structure .................................................................................................................... 5

Organizational Chart .................................................................................................................. 6

Parent and Affiliated Companies………………………………………………………….........6

Related Party Transactions ................................................................................................... 7

Administrative Expense Allocation Agreement between AFIC and AFLIC ....................... 8

General and Administrative Expense Allocation Agreement with FT

and its Subsidiaries ............................................................................................................. 8

Commission Agreement with FT and its Subsidiaries ......................................................... 8

Fidelity Bond and Other Insurance .......................................................................................................... 8

Pensions, Stock Ownership and Insurance Plans ..................................................................................... 9

Reinsurance……………………………………………………………………………………………...9

Territory and Plan of Operation ............................................................................................................... 9

Growth of Company……………………………………………………………………………………..9

Accounts and Records……………………………………………………………………………….....10

Statutory Deposits……………………………………………………………………………...……....10

Financial Statements .............................................................................................................................. 11

Introduction .............................................................................................................................. 11

Statement of Assets, Liabilities, Surplus and Other Funds ...................................................... 12

Summary of Operations ............................................................................................................ 13

Reconciliation of Capital and Surplus ...................................................................................... 14

Reconciliation of Examination Adjustments to Surplus ........................................................... 14

Market Conduct Activities ..................................................................................................................... 15

Policyholder Service ................................................................................................................. 15

Underwriting and Rating ........................................................................................................... 15

Claims Handling ....................................................................................................................... 15

Producer Licensing ................................................................................................................... 15

Privacy………………………………………………………………………………… ……...15

Commitments and Contingent Liabilities .............................................................................................. 16

Subsequent Events ................................................................................................................................. 16

Comments and Recommendations ......................................................................................................... 17

Acknowledgment ................................................................................................................................... 18

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 2

April 28, 2021

Honorable Mike Chaney

Commissioner of Insurance

Mississippi Insurance Department

1001 Woolfolk Building

501 North West Street

Jackson, Mississippi 39201

Dear Commissioner Chaney:

Pursuant to your instructions and authorization and in compliance with statutory provisions, an

examination has been conducted as of December 31, 2019, of the affairs and financial condition of:

AMERICAN FEDERATED LIFE INSURANCE COMPANY

406 Liberty Park Court

Flowood, MS 39232

License #

NAIC Group #

NAIC #

FEETS#

MATS#

8200016

0641

98736

98736-MS-2019-2

MS099-28

This examination was commenced in accordance with Miss. Code Ann. § 83-5-201 et seq. and

was performed in Flowood, Mississippi, at the statutory home office of the Company. The report

of examination is herewith submitted.

MIKE CHANEY

Commissioner of Insurance

State Fire Marshal

MARK HAIRE

Deputy Commissioner of

Insurance

MAILING ADDRESS

Post Office Box 79

Jackson, MS 39205-0079

TELEPHONE: (601) 359-3569

FAX: (601) 576-2568

MISSISSIPPI INSURANCE DEPARTMENT

501 N. WEST STREET, SUITE 1001

WOOLFOLK BUILDING

JACKSON, MISSISSIPPI 39201

www.mid.ms.gov

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 3

SCOPE OF EXAMINATION

We have performed a multi-state examination of American Federated Life Insurance Company

(“Company” or “AFLIC”). The last examination covered the period of January 1, 2011, through

December 31, 2014. This examination covers the period January 1, 2015, through December 31,

2019.

We conducted our examination in accordance with the NAIC Financial Condition Examiners

Handbook. The Handbook requires that we plan and perform the examination to evaluate the

financial condition, assess corporate governance, identify current and prospective risks of the

Company and evaluate system controls and procedures used to mitigate those risks. An

examination also includes identifying and evaluating significant risks that could cause an

insurer’s surplus to be materially misstated both currently and prospectively.

All accounts and activities of the Company were considered in accordance with the risk-focused

examination process. This may include assessing significant estimates made by management and

evaluating management’s compliance with Statutory Accounting Principles. The examination

does not attest to the fair presentation of the financial statements included herein. If, during the

course of the examination an adjustment is identified, the impact of such adjustment will be

documented separately following the Company’s financial statements.

This examination report includes significant findings of fact, as mentioned in the Miss. Code

Ann. §83-5-201, and general information about the insurer and its financial condition. There may

be other items identified during the examination that, due to their nature (e.g., subjective

conclusions, proprietary information, etc.), are not included within the examination report but

separately communicated to other regulators and/or the Company.

COMMENTS AND RECOMMENDATIONS OF PREVIOUS

EXAMINATION

The comment and recommendation included in the previous examination report was addressed

by the Company in a manner deemed acceptable by the Mississippi Insurance Department

(“MID”).

HISTORY OF THE COMPANY

AFLIC was incorporated in March 1983 as a life, accident and health insurer under the laws

of the state of Mississippi with 1,000,000 shares of $1 par value common stock authorized

and 200,000 shares issued. In June 1994 and April 2006, the Company’s board of directors

(“Board”) issued an additional 200,000 shares of $1 par value common stock. In December

2012, the Board declared a common stock dividend of the remaining 400,000 authorized

shares.

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 4

The Company made ordinary and extraordinary dividends to an upstream affiliate totaling

$7,568,000 during the examination period. AFLIC distributed $2,680,069 during 2017 and

$5,000,000 during 2018.

CORPORATE RECORDS

The minutes of the meetings of the Board of Directors (“Board”), prepared during the period

under examination, were reviewed along with the Articles of Incorporation and Bylaws, along

with any amendments thereto. The minutes appeared to be complete with regard to the matters

brought up at the meetings for deliberation, which included approval of the Company’s

investment portfolio and actions of the Company’s officers.

MANAGEMENT AND CONTROL

Stockholder

The Company is 100% owned by American Federated Holding Company.

Board of Directors

The Articles of Association and Bylaws vest the management and control of the Company's

business affairs with the Board. The members of the duly elected Board, along with their place

of residence, year appointed as a Director, and principal occupation, at December 31 2019, were

as follows:

Name and Residence

Year Elected/Appointed

Principal Occupation

Francis Clark Lee

Brandon, Mississippi

1995

President & Chief Executive Officer

Tower Loan of MS, LLC

James Leland Martin, Jr.

Jackson, Mississippi

2000

President

American Federated Insurance Co.

Steven Terry Page

Flowood, Mississippi

2017

Director, Accounting & Financial

Reporting

Tower Loan of Mississippi, LLC

Officers

The officers duly elected by the Board and holding office at December 31, 2019, are as follows:

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 5

Name and Residence

Year Elected/Appointed

Title

James Leland Martin, Jr.

2000

President

Francis Clark Lee

1995

Secretary/Treasurer

Robert Morris Berry

2019

Vice President

Steven Terry Page

2019

Vice President

Conflict of Interest

The Company had formal procedures whereby disclosure was made to the Board of any material

interest or affiliation on the part of any officer or director that was, or would likely be, a conflict

with the official duties of such persons. The statements were reviewed, and no conflicts or

exceptions to the Company’s policies were noted.

HOLDING COMPANY STRUCTURE

The Company is a member of an insurance holding company system as defined in Miss. Code

Ann. §83-6-1. Holding Company Registration Statements were filed during the examination

period with the MID in accordance with Miss. Code Ann. §§ 83-6-5 and 83-6-9. The statements

and applicable amendments were reviewed, and it appeared that any changes and material

transactions by and between the Company and its affiliates were disclosed appropriately.

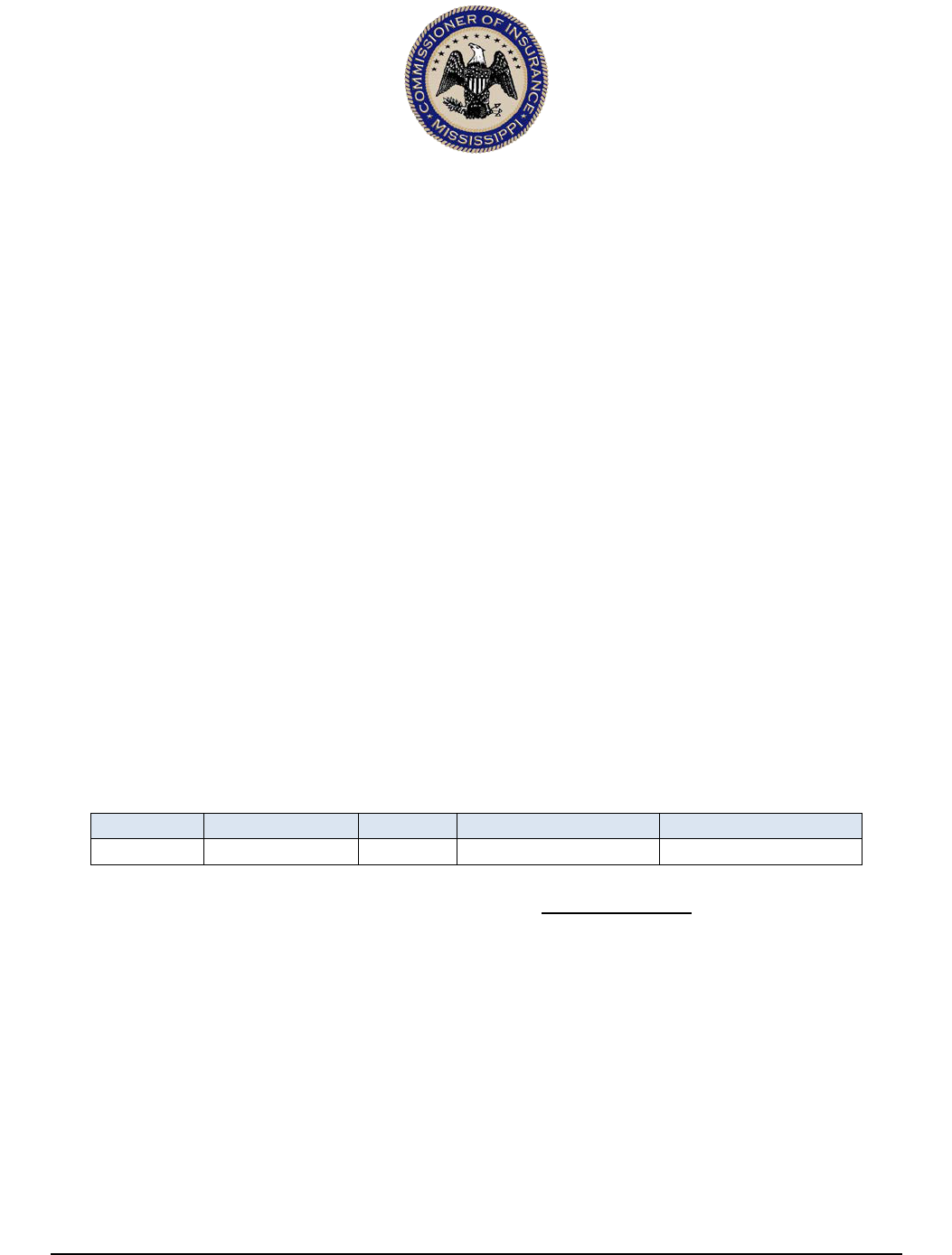

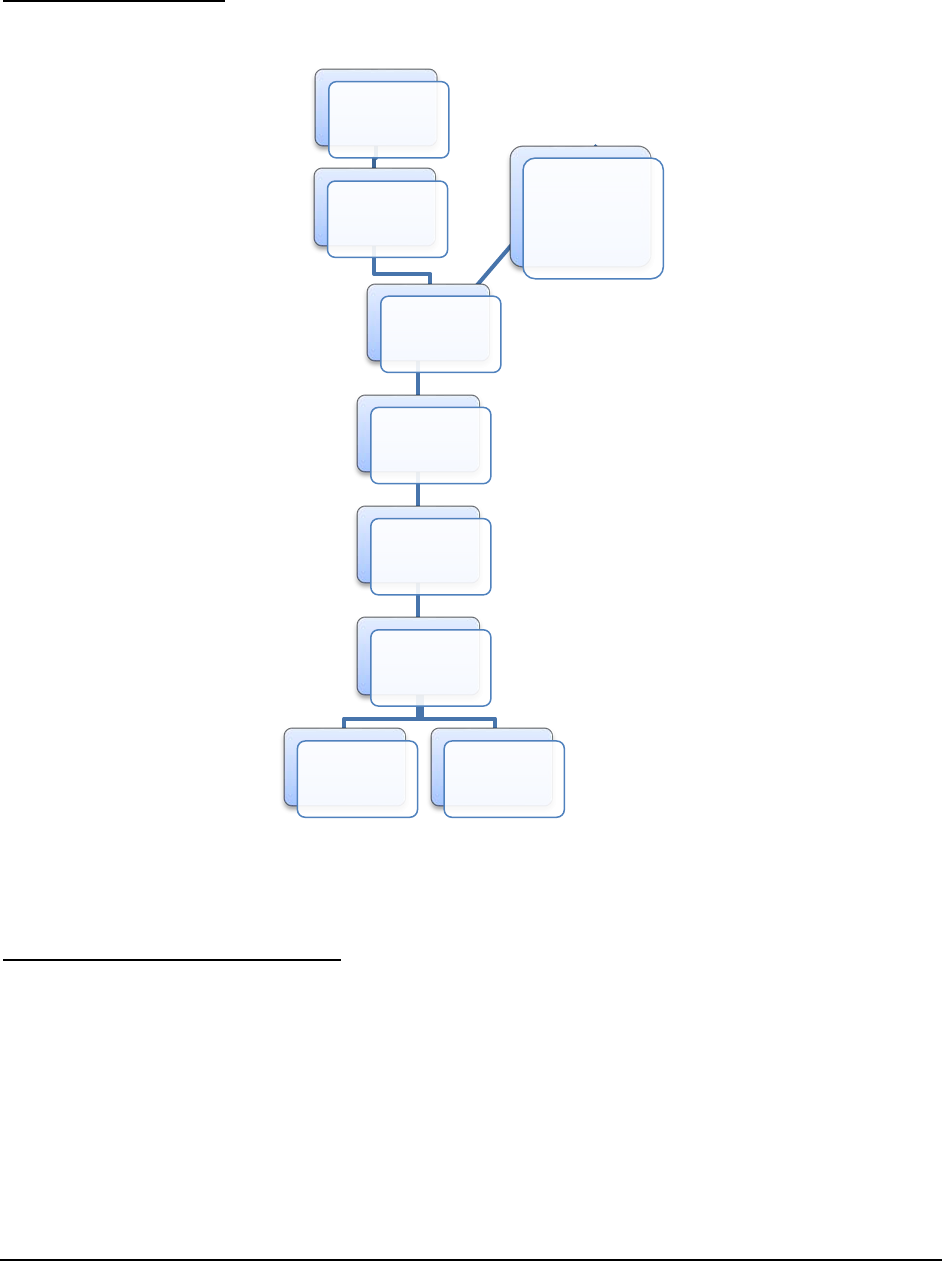

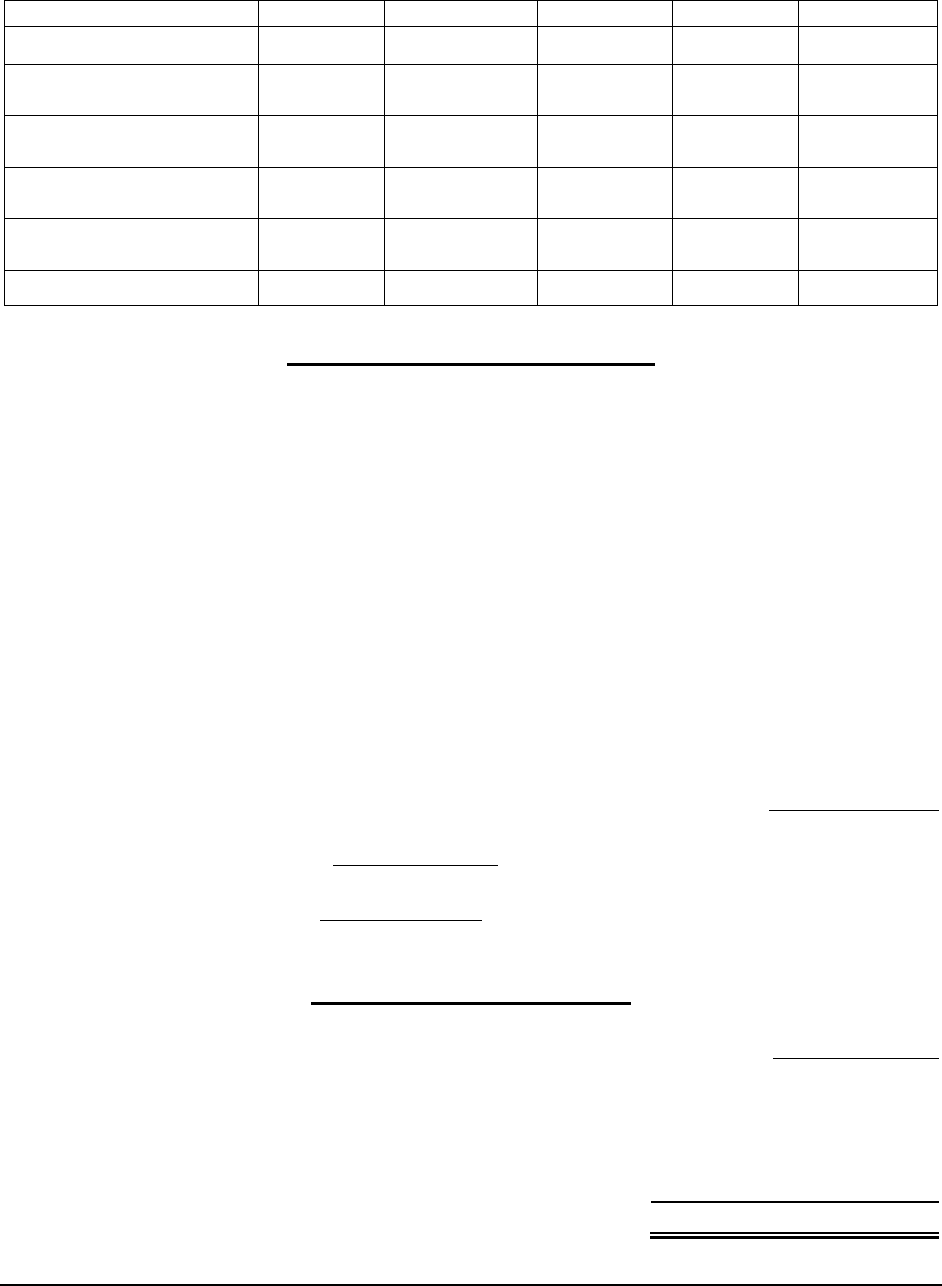

The following chart depicts the Company’s ownership as of December 31, 2019:

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 6

Organizational Chart

*Effective 1/1/2020, 100% of the shares owned by the Mary Katherine Lee Gift Trust of First

Tower Finance Company, LLC was transferred to Lee Investment Partners, LLC.

Parent and Affiliated Companies

The organizational chart above denotes the direct line of ownership of the Company. See

Schedule Y – Part 1 of the Annual Statement for the complete organizational chart.

Prospect Capital Corporation (“Prospect” or “Parent”): On June 15, 2012, Prospect acquired

an 80.0544% majority interest in First Tower Finance Company, LLC (f/k/a First Tower

Holdings, LLC, f/k/a First Tower Corporation), and its subsidiaries, through its wholly-owned

subsidiary, First Tower Holdings of Delaware, LLC.

Prospect Capital

Corporation

(100%)

First Tower

Holdings of

Delaware, LLC

(80.0544%)

First Tower Finance

Company, LLC

(100%)

First Tower, LLC

(100%)

Tower Loan of

Mississippi, LLC

(100%)

American

Federated Holding

Company

(100%)

American

Federated

Insurance Company

(MS Insurance

Company)

American

Federated Life

Insurance Company

(MS Insurance

Company)

Jack R. Lee 2006 Gift

Turst (14.0601%)

Mary Katherine Lee

2006 Gift Trust

(5.8286%)*

Jody Macon (.0569%)

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 7

Prospect is a publically-traded, closed-end investment company that has elected to be regulated

as a business development company under the Investment Company Act of 1940. Prospect

invests primarily in first and second-lien senior loans and mezzanine debt and provides capital to

middle-market companies and private equity financial sponsors for refinancing, leveraged

buyouts, acquisitions, recapitalizations, later-stage growth investments and capital expenditures.

First Tower Holdings of Delaware, LLC (“FT Delaware”): FT Delaware is a wholly-owned

subsidiary of Prospect. FT Delaware operates as a holding company which owns 80.0544 % of

First Tower Finance Company, LLC.

First Tower Finance Company, LLC (“FT Finance”): FT Finance is owned 80.0544% by FT

Delaware and 19.8887% by the Jack R. Lee and Mary Katherine Lee Gift Trusts. FT Delaware

and the Jack R. Lee and Katherine Lee Gift Trusts are Class A (voting) members with one Class

B (non-voting) member owning .0569%. FT Finance operates as a holding company which

wholly-owns First Tower, LLC.

First Tower, LLC (“FT”): FT is wholly-owned by FT Finance and is engaged in consumer

lending and related insurance activities through its wholly-owned subsidiaries, Tower Loan of

Mississippi, LLC, Tower Loan of Illinois, LLC, First Tower Loan, LLC, Gulfco of Mississippi,

LLC, Gulfco of Alabama, LLC, Gulfco or Louisiana, LLC, Tower Loan of Missouri, LLC, and

Tower Auto Loan, LLC.

Tower Loan of Mississippi, LLC (“TL of MS”): TL of MS is wholly-owned by First Tower

and is engaged in consumer lending in the states of Mississippi and Louisiana. TL of MS

provides insurance services through its wholly-owned subsidiary, American Federated Holding

Company.

American Federated Holding Company (“AFHC”): AFHC is wholly-owned by TL of MS

and acts as an insurance holding company for two insurance subsidiaries, the Company and

American Federated Insurance Company (“AFIC”).

American Federated Insurance Company (“AFIC”): AFIC is wholly-owned by AFHC. AFIC

provides credit property insurance on consumer loans issued by consumer finance subsidiaries of

TL of MS.

Related Party Transactions:

Premiums: Premiums are collected for credit life and accident and health insurance at each of the

consumer finance branch offices and remitted by TL of MS to the Company on a monthly basis.

At December 31, 2019, the Company reported a receivable from parent, subsidiaries and

affiliates in the amount of $2,029,300 related to premiums owed for December.

Claims: Upon submission of appropriate claim documentation and proof of loss, the Company

pays claims to affiliated consumer finance branch offices to be applied to the insured’s

outstanding loan balances.

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 8

Administrative Expense Allocation Agreement between AFIC and AFLIC:

The Company was party to an expense allocation agreement amended January 1, 2013. Pursuant

to this agreement, certain shared expenses are initially paid out of AFIC and subsequently

reimbursed to AFIC by AFLIC. At December 31, 2019 the amounts payable to AFIC pursuant to

this agreement was $22,617. The agreement dictates that payment by AFLIC to AFIC of the

monthly expense allocation will occur by the end of the month following the monthly expenses

incurred by the Company.

General and Administrative Expense Allocation Agreement with FT and its Subsidiaries:

Effective June 15, 2012, the Company entered into a General and Administrative Expense

Allocation Agreement with FT and each of its wholly-owned subsidiaries. Pursuant to this

agreement, FT will prepare monthly a calculation of general and administrative expenses and the

pro rata share to be allocated to the Company based on the ratio of the Company’s total revenues

in any calendar month to the total revenue generated in any calendar month by each of FT’s

finance company subsidiaries. The Company is required to remit payment within fifteen (15)

days after receiving a monthly statement from FT. At December 31, 2019, amounts payable

pursuant to this agreement were $294,342.

Commission Agreement with FT and its Subsidiaries:

Effective June 15, 2012, the Company entered into a Commission Agreement with FT and each

of its wholly-owed finance company subsidiaries. Pursuant to this agreement, once the Company

has received all premiums for any given month, the Company shall calculate the commissions

due to each of the finance company subsidiaries and shall remit any commissions owed no later

than the last day of the month following the month in which the commissions are earned.

Commissions paid shall be reasonable and shall be equal to a percentage of the premium of each

insurance policy written but shall be no higher than the maximum rate permitted under the

applicable state statute. At December 31, 2019, amounts payable pursuant to this agreement were

$843,708.

The consumer finance operating subsidiaries of FT agree to assist the Company to ensure that the

proper licenses are maintained for all finance company employees authorized to place insurance

policies and that such persons are appropriately appointed in accordance with applicable laws.

FIDELITY BOND AND OTHER INSURANCE

The Company maintained a commercial insurance policy for employee theft with a limit of

$500,000. This amount meets the NAIC suggested minimum fidelity coverage for a company of

its size. The Company also maintained an insurance program that appeared to provide adequate

coverage to protect it from hazards that it may encounter.

The Company had additional types of coverage in-force at December 31, 2019, including, but

not limited to, directors and officers, excess liability and excess financial products insurance.

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 9

PENSIONS, STOCK OWNERSHIP AND INSURANCE PLANS

The Company's employees have the opportunity to participate in a qualified defined contribution

plan that is sponsored by an affiliate. In addition to pension benefits, an affiliate provides certain

health and dental benefits.

REINSURANCE

The Company was not a party to any reinsurance contracts during the examination period.

TERRITORY AND PLAN OF OPERATION

The Company provides credit life and accident and health insurance on consumer loans issued by

consumer finance operating subsidiaries of FT. The Company's customer base is comprised of

mostly individuals unable to secure loans through conventional lending channels. The loans are

fully collateralized and average $3,400 with an average life of twenty (20) months (average term

at loan issuance is twenty-six (26) months).

The Company markets its products exclusively through the consumer financial branches of

the FT. FT owns several consumer finance companies with over two hundred and thirty (230)

branches throughout Alabama, Louisiana, Illinois, Mississippi and Missouri.

As of December 31, 2019, the Company was authorized to write the following lines of business

in the state of Mississippi:

Accident and health Life

Credit life, credit accident and health

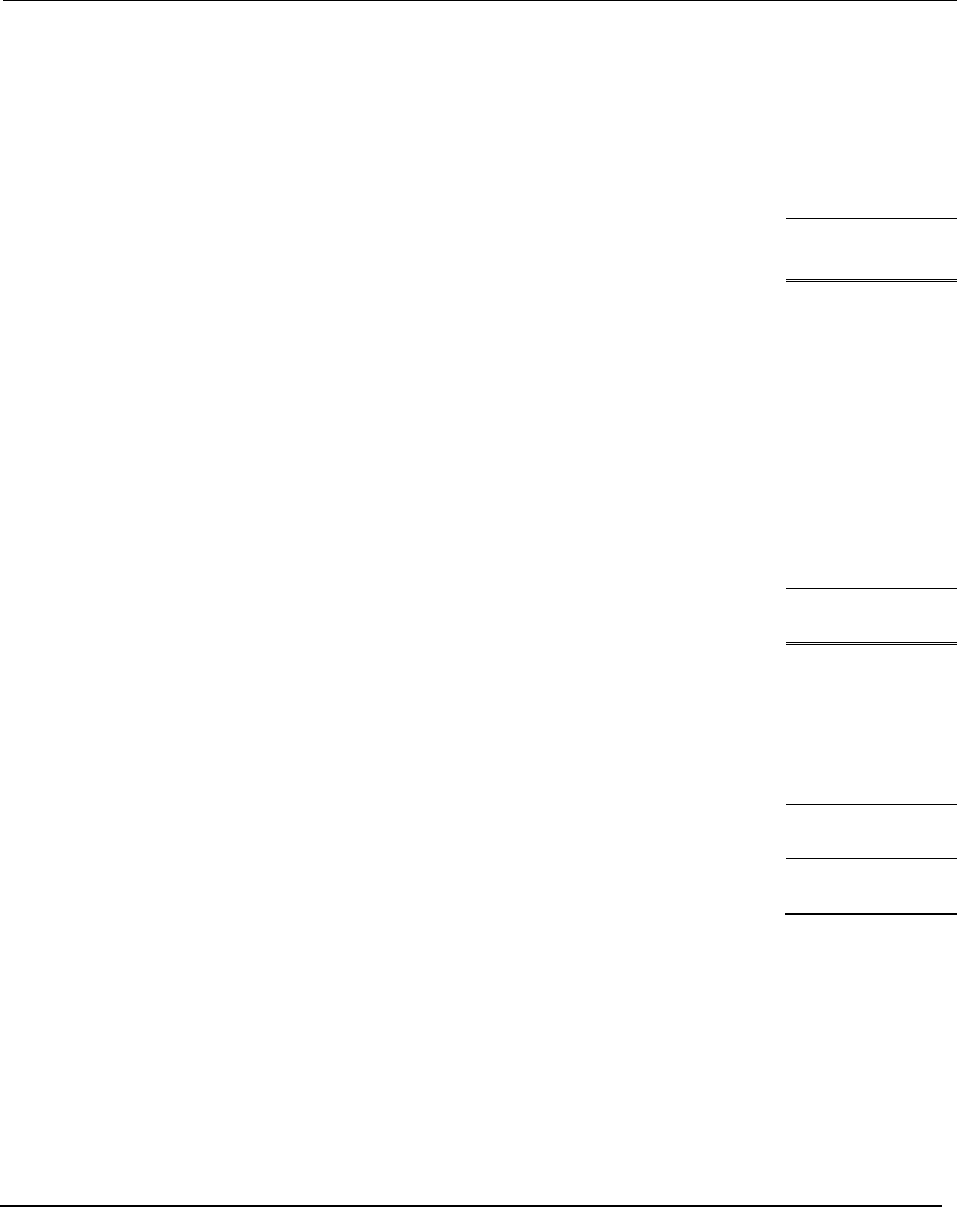

GROWTH OF COMPANY

The review of the growth of the Company was performed based on balances as reported in the

annual statements filed with the MID during the period under examination.

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 10

ACCOUNTS AND RECORDS

The Company's 2019 trial balance was tied to the financial statements within the statutory annual

statement filed with the MID, with no material exceptions noted. The Company was audited

annually by an independent CPA firm and its Aggregate reserve for life and accident and health

contracts and contract claims liabilities were reviewed by an consulting actuary who issued an

actuarial opinion for each of the years under examination.

Marc Altschull from Merlinos was engaged as the Examination Consulting Actuary to review

that Company’s loss and loss adjustment reserves.

The Company utilized internally developed software, Progress, to manage policies, process

claims and prepare certain financial information. FT maintains an IT department that

encompassed a hardware and software technology group, branch application support group and

quality assurance group.

The Company was licensed as a single-line insurance company pursuant to Miss. Code Ann.

§ 83-19-31(a), which required the Company to maintain a minimum capital of $400,000 and

surplus of $600,000. Pursuant to Miss. Code Ann. § 83-5-55, the Company was required to file

an NAIC Life and Health Annual Statement. The Company was also required to file a risk-based

capital (RBC) report pursuant to Miss. Code Ann. § 83-5-401 through § 83-5-427.

STATUTORY DEPOSITS

The Company's statutory deposits with the state of Mississippi complied with Miss. Code Ann.

§83-19-31(2) and §83-7-21. The following chart displays the Company's deposits at

December 31, 2019:

Description of Security

Par Value

Fair Value

US Treasury Notes

$ 1,595,000

$ 1,595,628

Total

$ 1,595,000

$ 1,595,628

2019

2018

2017

2016

2015

Change in surplus

$884,601

$(1,574,349)

$(223,843)

$2,929,534

$(1,120,645)

Ratio of premiums earned

to capital and surplus

1.67 to 1

1.75 to 1

1.28 to 1

1.26 to 1

1.70 to 1

Ratio of assets to

liabilities

1.61 to 1

1.57 to 1

1.59 to 1

1.53 to 1

1.37 to 1

Ratio of revenues to

expenses

1.04 to 1

1.07 to 1

1.19 to 1

1.23 to 1

0.93 to 1

Cash flows from

operations

$1,514,794

$1,525,585

$ 1,114,909

$1,685,907

$2,709,129

Net income (loss)

$791,640

$1,180,321

$2,436,717

$2,898,820

$(1,168,353)

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 11

FINANCIAL STATEMENTS

Introduction

The financial statements consist of a Statement of Assets, Liabilities, Surplus and Other Funds as

of December 31, 2019, a Summary of Operations for year ended December 31, 2019, and a

Reconciliation of Capital and Surplus for the examination period ended December 31, 2019.

The following financial statements are based on the statutory financial statements filed by the

Company with the Mississippi Insurance Department and present the financial condition of the

Company for the period ending December 31, 2019.

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 12

Statement of Assets, Liabilities, Surplus and Other Funds

December 31, 2019

Assets

Bonds

$ 23,051,344

Cash and short-term investments

3,024,246

Investment income due and accrued

207,079

Current federal and foreign income tax recoverable

56,103

Net deferred tax asset

234,879

Receivables from parent, subsidiaries and affiliates

2,029,300

Aggregate write-ins for other-than-invested assets

2,880

Total assets

$ 28,605,831

Liabilities, Capital and Surplus

Aggregate reserve for life contracts

$ 7,954,654

Aggregate reserve for accident and health contracts

7,419,814

Contract claims: life

772,222

Contract claims: accident and health

186,000

Interest maintenance reserve

10,463

General expenses due or accrued

16,857

Taxes, licenses, fees, and other expenses due or accrued

109,883

Asset valuation reserve

88,179

Payable to parent, subsidiaries and affiliates

1,160,667

Total liabilities

17,718,739

Common capital stock, $1 par value; 1,000,000 shares

authorized, issued and outstanding

1,000,000

Gross paid in and

contributed surplus

300,000

Unassigned funds (surplus)

9,587,092

Total capital and surplus

10,887,092

Total liabilities, capital and surplus

$ 28,605,831

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 13

Summary of Operations

For the Examination Period Ended December 31, 2019

Revenue

Premiums and annuity considerations for life and accident and health contracts

$ 18,212,081

Net investment income

666,385

Amortization of interest maintenance reserve

(6,835)

Aggregate write-ins for miscellaneous income

6,961

Total revenues

18,878,592

Expenses

Death benefits

$ 3,667,414

Disability benefits and benefits under accident and health contracts

1,535,284

Increase in aggregate reserves for life and health contracts

1,088,066

Commissions

7,563,738

General insurance expenses

3,838,313

Insurance taxes, licenses and fees, excluding federal income taxes

579,625

Total benefits and expenses

18,272,440

Federal and foreign income taxes incurred

(153,570)

Net realized capital gains

31,918

Net income

$ 791,640

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 14

Reconciliation of Capital and Surplus

For the Examination Period Ended December 31, 2019

2019

2018

2017

2016

2015

Capital and surplus,

December 31, prior

year

$10,002,493

$11,576,842

$11,800,685

$8,871,171

$9,991,796

Net income

791,640

1,180,321

2,436,717

2,898,820

(1,168,333)

Change in asset

valuation reserve

(7,667)

9,780

10,194

(10,889)

(12,296)

Change in reserves on

account of change in

valuation basis

-

2,760,627

-

-

-

Change in net

deferred income tax

(15,819)

(408,632)

8,834

40,843

59,193

Dividends to

stockholders

-

(5,000,000)

(2,680,069)

-

-

Change in non-

admitted assets

116,445

(116,445)

481

740

811

Capital and surplus,

December 31, current

year

$10,887,092

$10,002,493

$11,576,842

$11,800,685

$8,871,171

Reconciliation of Examination Adjustments to Surplus

For the Examination Period Ended December 31, 2019

There were no changes made to the assets, liabilities or surplus balances reported by the

Company for the year ended December 31, 2019. The capital and surplus reported by the

Company of $10,887,092 is accepted as reasonably stated for purposes of the balance sheet per

the examination and in compliance with Miss. Code Ann. §83-19-31.

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 15

MARKET CONDUCT ACTIVITIES

A full market conduct examination was not conducted; however, specific areas of the market

conduct activities were reviewed. The specific areas reviewed included those items as indicated

below. No significant exceptions with regard to limited procedures performed were noted.

Policyholder Service

The Company maintained a complaint log during the period under examination. All complaints

appeared to have been appropriately resolved and no policyholder abuse was noted.

Underwriting and Rating

The Company appeared to be appropriately applying premium rates for insured policies based on

application data.

It appeared that all applicable policy forms had been appropriately approved by the MID.

Claims Handling

Claim files were reviewed for general indicators of policyholder treatment concerns noting no

material exceptions.

Producer Licensing

The Company appeared to have the appropriate licensure to issue its products, and agents

appeared to be properly licensed and appointed.

Privacy

Privacy notices were sent to the Company's policyholders annually which appeared to be in

compliance with applicable laws and standards.

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 16

COMMITMENTS AND CONTINGENT LIABILITIES

Procedures performed during the course of the examination revealed no pending litigation,

commitments or other contingent liabilities to which the Company was a party.

SUBSEQUENT EVENTS

Effective January 1, 2020, 100% of the shares owned by the Mary Katherine Lee Gift Trust of

First Tower Finance Company, LLC was transferred to Lee Investment Partners, LLC. First

Tower Finance Company, LLC is an upstream affiliate of the Company.

The Company ceased writing new business in the State of Illinois effective the first quarter of

2021.

The Company did not receive any funds under the Paycheck Protection Program provided under

the Coronavirus Aid, Relief, and Economic Security Act.

Subsequent to the year ending December 31, 2019, the Company submitted an attestation

requesting exemption from the filing requirements of the Insurance Data Security Law on the

grounds the Company had less than fifty (50) employees. The Company’s request for exemption

from the filing requirements was accepted by the MID.

On March 11, 2020, the World Health Organization declared the spreading coronavirus

(COVID-19) outbreak as a pandemic. On March 13, 2020, U.S. President Donald J. Trump

declared the coronavirus pandemic a national emergency in the United States. The

epidemiological threat posed by COVID-19 had disruptive effects on the economy, including

disruption of the global supply of goods, reduction in the demand for labor, and reduction in the

demand for U.S. products and services, resulting in a sharp increase in unemployment. The

economic disruptions caused by COVID-19 and the uncertainty about the magnitude of the

economic slowdown caused extreme volatility in the financial markets.

The Company has been in communication with the Mississippi Insurance Department regarding

the impact of COVID-19 on its business operations and financial position. The Company has

experienced losses in 2020 and 2021 due to COVID-19 with losses expected to subside during

the remainder of 2021. No losses incurred have had a material impact on the Company’s

financial position.

American Federated Life Insurance Company

MID Examination as of December 31, 2019 Page 17

COMMENTS AND RECOMMENDATIONS

The examination did not identify any material comments and recommendations.