ANNUAL

REPORT

OFFICE OF FINANCIAL REGULATION

Maryland Department of Labor

FOR FISCAL YEAR ENDED JUNE 30, 2023

PRESENTED TO:

Wes Moore, Governor

Aruna Miller, Lt. Governor

Table of ContentsFinancial Regulation Annual Report 2023

TABLE OF

CONTENTS

12 Message from the Commissioner

15 Fiscal Year 2023 Highlights

16 Equity and Access to Financial Services

18 Monetary Recoveries for Consumers and Penalties Assessed

20 Legislative and Regulatory Summary

23 Depository Supervision

24 Bank Supervision

04 List of Abbreviations

06 About the Office

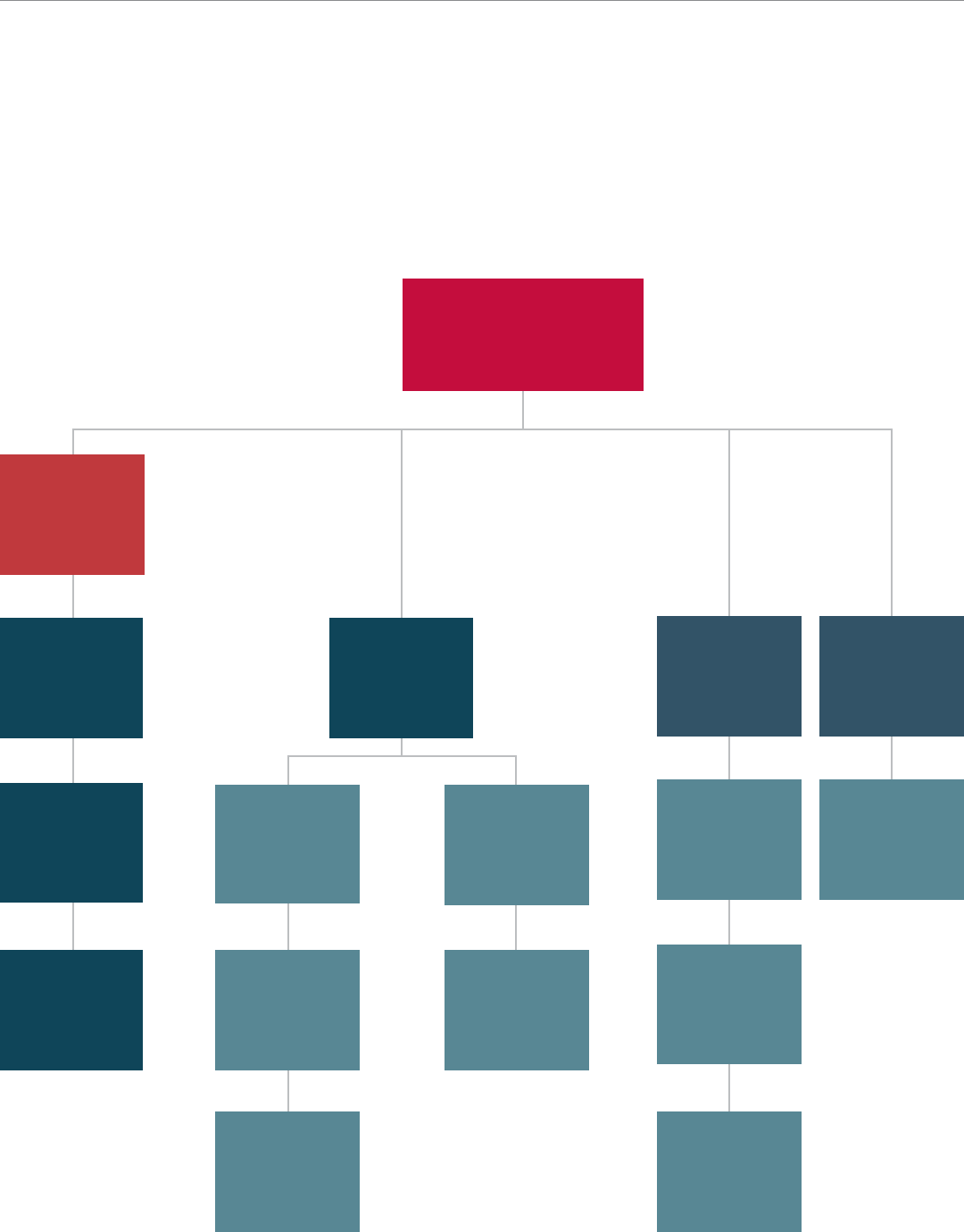

07 Senior Management

08 Management Organizational Chart

09 Accreditation, Innovation and Regulatory Harmonization

2

SECTION

ACHIEVEMENTS & PRIORITIES

3

SECTION

INDUSTRY SUPERVISION & CONSUMER PROTECTION

1

SECTION

OUR OFFICE

Financial Regulation Annual Report 2023 Table of Contents

25 Credit Union Supervision

26 Non-Depository Trust Company Supervision

28 Depository Corporate Activities

30 Licensing

32 Financial Services Supervision

32 Mortgage Supervision

33 Money Services and Consumer Credit Supervision

35 Consumer Services

36 Enforcement

41 Foreclosure Systems Administration

45 State Collection Agency Licensing Board

46 Student Loan Ombudsman

47 Outreach and Education

50 APPENDIX A: State-Chartered and Depository Institutions – Facts & Figures

67 APPENDIX B: Financial Statements – Office Revenues and Expenditures

75 APPENDIX C: Historical Lists of Commissioners and Deputy Commissioners

4

SECTION

APPENDICES

Page 4 of 84

Financial Regulation Annual Report 2023

LIST OF

ABBREVIATIONS

AARMR American Association of Residential Mortgage Regulators

ASI American Share Insurance

BTFP Bank Term Funding Program

CECL Current expected credit losses

CSBS Conference of State Bank Supervisors

CSU Consumer Services Unit

DHCD Department of Housing and Community Development (Maryland)

FDIC Federal Deposit Insurance Corporation

FFIEC Federal Financial Institutions Examination Council

FOMC Federal Open Market Committee

FPR Foreclosed Property Registration

FY or FYE Fiscal Year or Fiscal Year End

HAF Homeowner Assistance Fund

LID Low-Income Designation

LMI Low-to-moderate income

MMC Multistate Mortgage Committee

MMLA Multistate Money Service Businesses Licensing Agreement

MSCCS Money Services and Consumer Credit Supervision

MTRA Money Transmitter Regulatory Association

NACARA North American Collection Agency Regulatory Association

NCUA National Credit Union Administration

NMLS Nationwide Multistate Licensing System

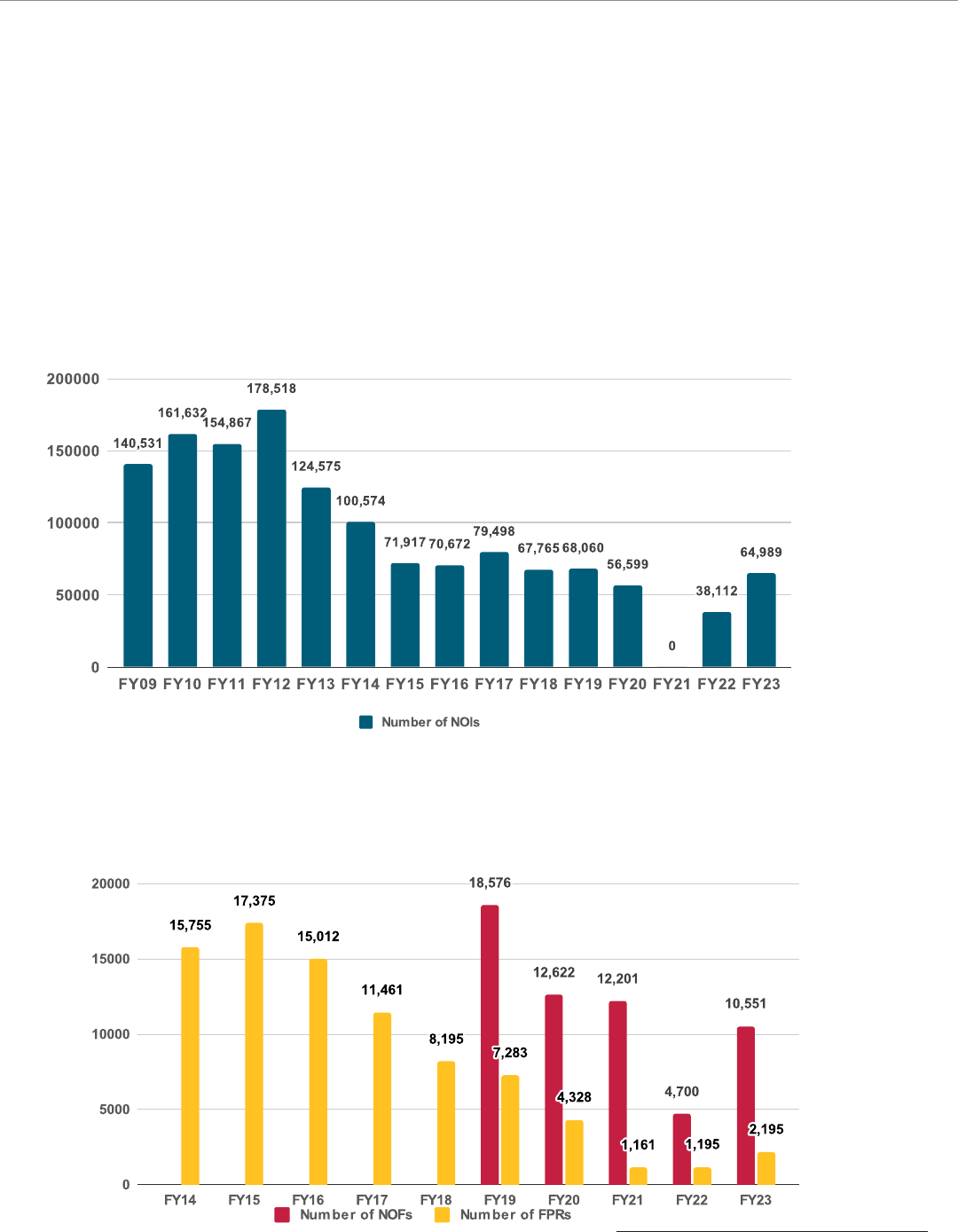

NOF Notice of Foreclosure

NOI Notice of Intent to Foreclose

OCC Office of the Comptroller of the Currency

OFR Office of Financial Regulation

PPP Payroll Protection Program

ROA Return on assets

SES State Examination System

Financial Regulation Annual Report 2023 Page 5 of 84

We protect Marylanders

through the operation

of a modern financial

regulatory system

that promotes respect

for consumers, safety

and compliance, fair

competition, responsible

business innovation, and

a strong state economy.

OUR OFFICE

Page 6 of 84

Financial Regulation Annual Report 2023

ABOUT THE

• Lenders that issue or service

mortgage loans, personal loans,

vehicle loans, or installment loans.

• Check cashing and money

transmission services.

• Collection agencies and consumer

credit reporting agencies.

• Debt management and credit

repair businesses.

• Sales financing companies and

student loan servicing companies.

• Banks, credit unions, and trust

companies chartered in Maryland.

1

To fulfill its consumer protection

and regulatory responsibilities, OFR:

• Charters Maryland financial

institutions and licenses or

registers companies or individuals

that provide financial services

to Maryland consumers

(collectively referred to as

“financial service providers”).

• Supervises financial institutions

and financial service providers

by conducting examinations or

investigations to ensure compliance

with state laws and regulations.

• Receives and investigates

complaints from Maryland

consumers and others involving

regulated financial institutions

and financial service providers,

including reports of fraud or

other illegal activity.

Maryland law gives OFR enforcement authority over regulated industries

providing financial services or undertaking consumer collection activities in

the state, specifically including the state-chartered, licensed, and supervised

institutions. The Office possesses its own investigative resources with which to

enforce state law and support the State Collection Agency Licensing Board.

When appropriate, OFR works cooperatively with other state and federal

regulatory organizations and law enforcement agencies to investigate and

prosecute violations of law.

To improve compliance with Maryland law, OFR provides information,

guidance, and assistance to regulated companies and individuals through

advisories, webinars, and other means that emphasize industry’s responsibilities.

Office leadership and staff are in ongoing contact with interested federal,

state and local government and nonprofit agencies to keep them informed of

issues and trends affecting Maryland consumers and financial service businesses.

The Office and the Maryland Student Loan Ombudsman (designated by the

Commissioner of Financial Regulation) conduct outreach on issues under

OFR’s jurisdiction, with a focus on foreclosure and mortgage delinquencies

in the state and student loan issues. Additionally, OFR strives to educate

Maryland consumers about their rights and legal protections.

The Commissioner provides support and information about financial regulatory

matters to the Governor, Secretary of the Maryland Department of Labor,

other state agencies, and the Maryland General Assembly.

The Office of Financial Regulation (OFR or the “Office”) in the Maryland Department of Labor is Maryland’s consumer

financial protection agency and financial services regulator. The Office ensures that the financial services industry treats

Maryland consumers fairly, follows applicable state laws and regulations, and operates in a fiscally sound manner.

The Ofce of Financial

Regulation is Maryland’s

consumer nancial

protection agency and

nancial services regulator.

1

For a more exhaustive list and exceptions, see the “Regulated Financial Industries and Activities”

page on OFR’s website at labor.maryland.gov/finance/industry/frregulatedind.shtml.

The industries regulated by

OFR include:

OFFICE

Page 7 of 84

Financial Regulation Annual Report 2023

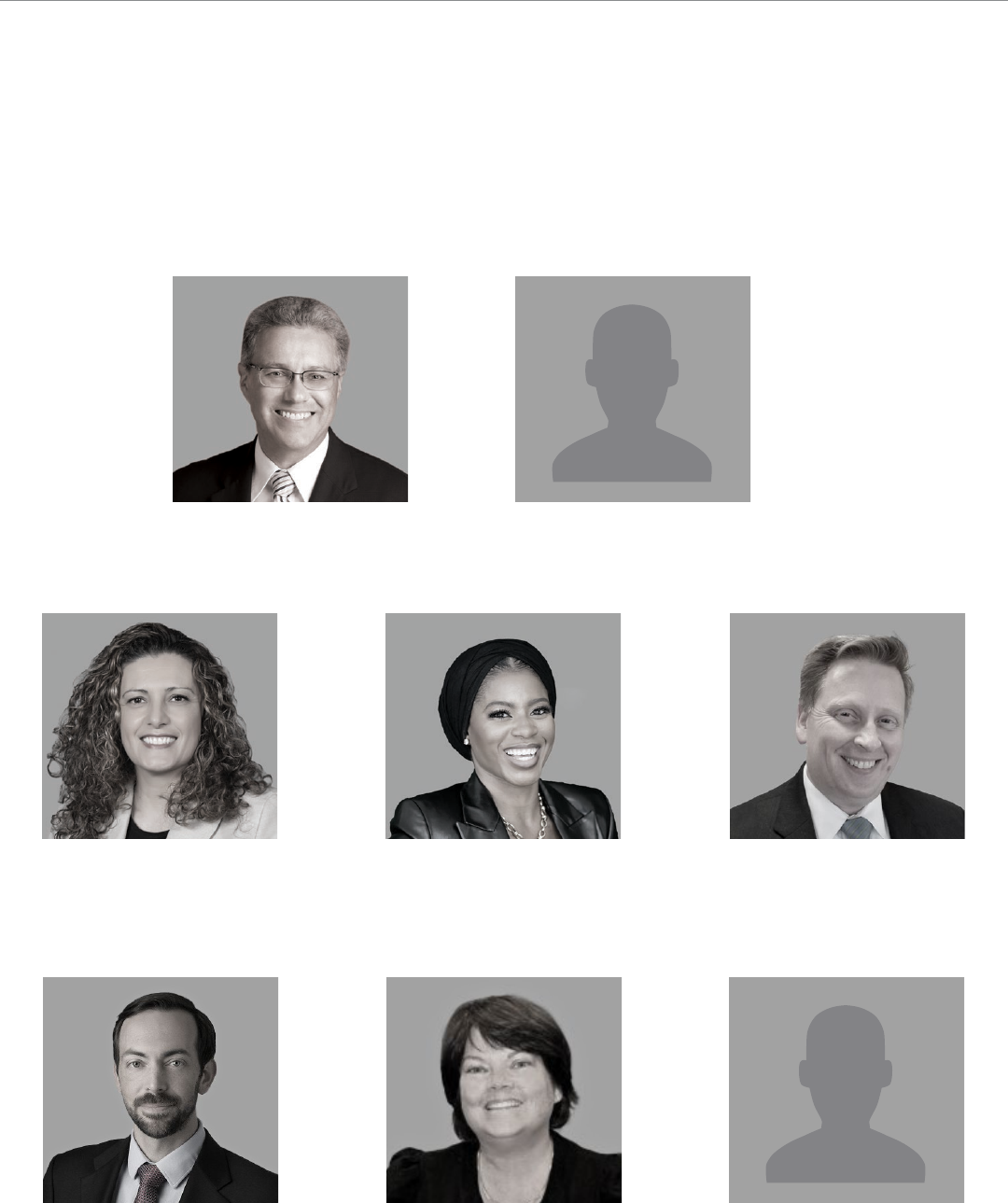

FISCAL YEAR 2023

Assistant Commissioner -

Depository Supervision

Teresa Louro

Assistant Commissioner -

Corporate Activities

Stephen Clampett

Director of

Administration

Michelle Denoncourt

Assistant Commissioner -

Financial Services

Licensing and Supervision

Shereefat Balogun

Commissioner of

Financial Regulation

Antonio “Tony” Salazar

Deputy Commissioner of

Financial Regulation

Vacant

Assistant Commissioner -

Consumer Services,

Outreach and Trend Analysis

Sean McEvoy

Assistant Commissioner -

Policy

Vacant

SENIOR MANAGEMENT

Page 8 of 84

Financial Regulation Annual Report 2023

MANAGEMENT

Director of

Licensing

Arlene Williams

Director of

Money Services &

Consumer Credit

Supervision

Sabrina Brown

Director of

Administration

Michelle Denoncourt

Director of

Mortgage

Supervision

Christine Brooks

Assistant

Commissioner -

Corporate Activities

Stephen Clampett

Assistant

Commissioner -

Financial Services

Licensing &

Supervision

Shereefat Balogun

Assistant

Commissioner -

Depository

Supervision

Teresa Louro

Deputy

Commissioner of

Financial Regulation

Vacant

Director of

Trend Analysis &

Reporting

Brendan Armbruster

Director of

Outreach &

Education

Meredith Merchant

Director of

Consumer Services

Priscilla Wynn

Assistant

Commissioner -

Consumer Services,

Outreach & Trend

Analysis

Sean McEvoy

Director of

Legislative

Response &

Acting Student

Loan Ombudsman

Amy Hennen

Assistant

Commissioner -

Policy

Vacant

Director of

Operations

Cliff Charland

Director of

Enforcement

Dana Allen

Commissioner of

Financial Regulation

Antonio “Tony” Salazar

ORGANIZATIONAL CHART

Page 9 of 84

Financial Regulation Annual Report 2023

ACCREDITATION, INNOVATION AND REGUL ATORY

Accreditation

The Office has been accredited by the Conference of State Bank

Supervisors (CSBS) for its regulation of state-chartered banks since

July 13, 1992. State bank regulatory agencies must undergo a re-

accreditation examination and audit every five years and submit annual

assessment updates to retain certification. The CSBS Accreditation

Program is designed to encourage the standardization of state-

chartered bank supervision, identify weaknesses, and capitalize on

the strengths of state banking agencies. The process assists OFR in

effectively carrying out its responsibilities in supervising Maryland-

chartered financial institutions, of ensuring that institutions operate

in a safe and sound manner, legal and regulatory compliance, and

providing responsive services.

The Office has been accredited for its mortgage supervision by

CSBS and the American Association of Residential Mortgage

Regulators (AARMR) through their joint accreditation program since

August 31, 2016. Mortgage accreditation serves the same purpose

as banking accreditation but it applies to the supervision of non-

depository mortgage brokers, lenders, and servicers, and it requires,

among other things, that OFR’s policies and procedures in licensing,

examination, enforcement, and consumer complaint response

meet high standards and follow best practices.

The Office received its initial money services businesses accreditation

from CSBS and the Money Transmitter Regulators Association on

June 28, 2022. Maryland is the seventh state financial regulatory

agency (out of all the U.S. states and territories) to apply for money

services businesses accreditation. The money services businesses

program is responsible for supervising the activities of financial service

providers that offer check cashing or money transmission services to

Maryland residents. The Office conducts examinations and investigates

complaints from Maryland consumers about these businesses.

Fintech Innovation Contact

Significant changes continue to occur in the

financial services sector. The Office is committed

to fostering a regulatory environment that supports

a robust, accessible, and equitable financial

system that features responsible innovation and

fair competition. The Office’s designated Innovation

Contact continued to support innovation efforts

in the financial services sector and to facilitate

communication between OFR, entrepreneurs,

and financial technology (“fintech”) companies.

The Innovation Contact is the Office’s point of

contact for entrepreneurs, fintech officials, and

new fintech companies who need assistance in

navigating the licensing process, reviewing

business concepts, evaluating risk management

and compliance management systems,

and providing feedback on business plans.

Additionally, the Innovation Contact is available

to provide information about doing business

in Maryland and to answer questions about

Maryland’s financial laws, rules, and regulations

as they might affect financial products in fields

such as money transmission, virtual currencies,

payments, or lending.

Assistant Commissioner Shereefat Balogun

assumed the role of Innovation Contact in

FY 2023 following the departure of Deputy

Commissioner Greg Thoreson. Throughout FY

2023, the Innovation Contact regularly received

and, with the assistance of the newly formed

High-Quality Standards, Evolving Financial Technologies and Coordinated Supervision

HARMONIZATION

Page 10 of 84

Financial Regulation Annual Report 2023

Innovation and Emerging Issues Committee, responded to inquiries

regarding how Maryland’s financial regulatory system impacted

current and prospective fintech companies operating or seeking to

operate within the State.

Having been informally created in FY 2022 and established under

a formal charter in FY 2023, OFR’s Innovation and Emerging Issues

Committee is an internal cross-functional committee composed of

OFR managers that exists to: (1) support the Innovation Contact as

they seek to foster responsible innovation in the financial services

sector; (2) facilitate communication between OFR staff and entities

offering financial services, (3) ensure the regulatory and supervisory

mandates of OFR are addressed on an intra-agency basis, and (4)

facilitate intra-agency and inter-agency communication regarding

emerging issues.

Networked Supervision

The Office maintains its active participation in multistate

coordination efforts with CSBS and sister state financial regulators

to foster innovation and the achievement of a modern, efficient

regulatory system. These multistate coordination efforts, referred to

as “networked supervision”, provide a more streamlined experience

for industry and regulators through the recognition of standards

and the coordination of activities across state lines.

The Office remains engaged in a multi-year effort to leverage

technology solutions and harmonize laws across states in order to

more effectively supervise financial service providers through a

networked approach with other financial regulators. These efforts

will enable regulated financial service providers to more fully engage

in national-scale activities while protecting consumers and the

financial system in each state. Examples of OFR’s participation

include the following:

• Leading negotiations, along with two other states, as part of a

multistate enforcement action against a payment processing

company for negligent customer data management practices

in processing mortgage payments.

• Continuing participation in the development and deployment of

next-generation technology platforms to streamline licensing,

supervision, and enforcement.

• Participation in the pilot program “One Company One Exam”

for mortgage examinations.

• Continuing participation in multistate mortgage and money

service business examinations.

• Participating as a Phase 1 state under the Multistate Money

Services Businesses Licensing Agreement, responsible for

reviewing elements of money transmitter licensing applications

common to all states.

• Coordinating with other state regulators to harmonize licensing

and supervisory practices.

Office personnel continue to serve in key

roles impacting networked supervision. In

FY 2023, the Director of Operations for the

Financial Services Licensing and Supervision

Unit served as the President and as a member

of the Board of Directors of AARMR and was

recently re-elected to serve another term.

The Office’s Director of Mortgage Supervision

is currently serving on the AARMR/CSBS

Multistate Mortgage Committee which oversees

large multistate mortgage supervision, and the

Office’s Director of Money Service Business

and Consumer Credit Supervision serves on the

Education Steering Committee of the Money

Transmitter Regulatory Association which

establishes national standards for examiner

education. The Office also participates in the

ongoing efforts to modernize the Nationwide

Multistate Licensing System and the State

Examination System.

The Office continues to actively support

multistate efforts to establish new standards

and laws designed to harmonize, where

appropriate, the practices of state financial

regulators. In FY 2023, OFR proposed changes

to Maryland’s Money Transmission regulations.

The proposed changes, which are intended to

implement the Uniform Money Transmission

Modernization Act (“Uniform Act”) model

law, will further harmonize Maryland law with

that of other states and foster uniformity and

coordination in states’ regulation of money

transmitters. The proposed changes received

a number of comments during the notice and

comment period. In response to the comments

received, OFR issued a statement addressing

the significant and relevant issues raised in the

public comments. The Office also modified

the proposed rule to provide greater clarity on

certain issues and address some substantive

concerns. The modified proposal is expected to

be finalized and a final rule issued in FY 2024.

The Office, through Commissioner Salazar,

is taking a lead role in the national efforts to

encourage and assist states in adopting the

Uniform Act.

Financial Regulation Annual Report 2023 Page 11 of 84

Annual message from the

Commissioner, fiscal year

highlights, promoting equity

and access, monetary

recoveries and penalties,

and legislative and

regulatory summaries.

ACHIEVEMENTS &

PRIORITIES

Page 12 of 84

Financial Regulation Annual Report 2023

MESSAGE FROM THE

Antonio P. “Tony” Salazar has been

the Maryland Commissioner of

Financial Regulation since July 5, 2017.

I have the honor of presenting this

Fiscal Year’s (FY) Annual Report to

Governor Moore under the Office’s new

name: “Office of Financial Regulation’’.

After 113 years of being known as

“The Office of the Commissioner of

Financial Regulation’’, the Office’s new

name became effective on July 1, 2023.

Though the Office’s name has changed,

its mission of serving as Maryland’s

consumer financial protection agency

has not.

During FY 2023, OFR continued to

uphold its tradition of strong consumer

protection while also engaging in

effective and impactful regulatory and

supervisory activities, strengthening

its capabilities, and securing significant

legislative results. In that regard, and as

discussed below, the Office broached

the topics of climate change and

equitable access to financial services,

it gave public notice of its enforcement

priorities, and it continued to seek and

implement innovative ways to carry out

its mission. These are topics and trends

that will be continued in FY 2024 and

beyond.

Last year the Office laid out six goals

for FY 2023. The goals revolved around

the following topics and I am happy to

report that the Office made significant

advances in each of these areas:

1. Continuing the Office’s tradition of

strong consumer protection actions.

2. Engaging in effective and impactful

regulatory and supervisory activities.

3. Enhancing community and

industry engagement and

education.

4. Enhancing investment in staff.

5. Understanding data availability,

needs and usage.

6. Collaborating with sister state

regulators.

Many of the Office’s activities

advanced one or more of its goals. For

example, OFR continued pursuit of

several ongoing enforcement actions

and commenced new investigations

and cases. Some of the existing

cases involve complex legal issues

surrounding the rules to be followed

by non-banking companies who

partner with out-of-state banks to lend

in our state at rates that would not

be permitted by Maryland law. The

Office initiated 52 new investigations

involving violations of Maryland

consumer financial laws and issued

an Order to shutter the operations

of an entity operating a non-licensed

financial institution. The Office’s

licensing, supervisory and consumer

service units each identified and took

steps to remedy illegal, unlicensed,

and other harmful activities resulting

in changes in the business practices

and consumer restitution. Of note

was the Office’s leadership role in

concluding a multistate settlement

agreement with ACI Worldwide,

Inc. where OFR and other state and

federal regulators responded to the

company’s transmission of more

than 1.4 million erroneous mortgage

payment debit instructions affecting

over 478,000 consumers nationwide

and approximately 14,000 consumers

in Maryland. These and other actions

detailed below illustrate the Office’s

continued commitment to strong

consumer protection and impactful

regulatory activities.

During FY 2023, the Office issued a

revised set of enforcement priorities

to improve the allocation of its

investigative and legal resources. In

particular, the list of enforcement

priorities is intended to identify the

types of behaviors and practices OFR

determines to be the most abusive

and harmful to Maryland consumers

and the financial services industry.

The priorities are described below

and topically cover: new or innovative

products or services, bank-fintech

partnerships, recidivism, systemic

issues resulting in widespread

consumer harm, and redlining and

discrimination in lending.

Legislation pursued and supported

by OFR during the Maryland

Legislature’s 2023 session was

consequential as it ranged from

bills that changed the Office’s

name and, notably, the manner in

which it collects revenue from non-

depository entities, to important

advances for consumers in the

realms of equity and mortgage

lending.

COMMISSIONER

Page 13 of 84

Financial Regulation Annual Report 2023

Working with the Administration, the Office helped ensure the

passage of Governor Moore’s groundbreaking Access to Banking

Act (House Bill 548). The Act represents an innovative approach to

the objective of ensuring that all Marylanders and their respective

communities have access to financial services. The Act seeks to

improve communities’ access to physical branches of depository

institutions by providing depository institutions with incentives to

open and maintain their branches in low-to-moderate income (LMI)

communities, while also authorizing the Commissioner to utilize funds

from the Depository Special Fund to seed a public/private venture

fund that will have a mission of seeking financial technology products

and companies that can be instrumental in increasing lending to small

businesses in such communities.

The Office obtained passage of a bill that helps it meet its goal of

operating a modern regulatory system. The new law puts Maryland

at the forefront of the movement to improve the licensing of non-

depository entities by eliminating the concept of “branch” licenses,

and the paperwork, costs, and other administrative efforts that are

associated with issuing such licenses. It replaced the current licensing

and fee structure with a modern structure, one that involves the

issuance of one license per entity (instead of licensing each branch

location) and permits OFR to issue annual assessments in order to

fund its operations. The law created a reinstatement process allowing

licensees to renew their expired licenses rather than reapplying, and

it clarified requirements pertaining to the use of trade names. The

changes will guarantee the funding of OFR’s future non-depository

activities and are anticipated to reduce the burdens on regulated

industries while also streamlining the Office’s administrative

workflow.

With the passage of House Bill 1150, which was sought by OFR,

the Legislature modified Maryland’s mortgage lending laws to

clearly provide that shared appreciation arrangements are to be

governed by Maryland’s mortgage laws. While OFR believed that

such products were covered by the State’s mortgage laws, it sought

the clarification to avoid litigation and in response to products that

market participants argued were not covered by such laws. The

new law is intended to protect consumers from the risks inherent in

these complex transactions and OFR anticipates that the new law

will protect and benefit consumers by establishing a clear licensing

and regulatory framework for oversight of transactions that are

sometimes structured to avoid disclosure and other consumer

protection requirements.

The Office was also active on the regulatory front as it publicly

pursued two new regulations and commenced work on two others.

The publicly issued regulations dealt with foreclosure procedures

and, importantly, changes to the money transmitter regulations that

are designed to complete Maryland’s adoption of the Conference

of State Bank Supervisors’ (CSBS) Model Money Transmission

Act. In FY 2024, the Office intends to issue regulations on shared

appreciation mortgages and on the Office’s use and sharing of other

states’ mortgage examinations.

I, and other members of OFR, remained active in leadership

positions in multistate regulatory organizations. These positions

enhance our Office’s capabilities, enable OFR staff participation

in the development of national standards and policy and, overall,

strengthen our Office’s ability to protect consumers and reach our

goals. For example, I have been active in the Conference of State

Bank Supervisors, serving as the Vice Chair of the Non-Depository

Supervisory Committee. At the CSBS 2023 annual meeting, I was

elected to serve as the group’s Vice Chair. As

a member of the Federal Deposit Insurance

Corporation’s (FDIC) Advisory Committee of

State Regulators, I directly provided advice

and information to the Chairman and Board

of the FDIC. I also assumed a post as a

representative of the National Association of

State Credit Union Supervisors (NASCUS) to

the FBIIC (Financial and Banking Infrastructure

Information Committee). It is a post that keeps

me, and through me the Office, connected with

technology and cyber issues at the highest

levels of government. Other OFR staff, including

Directors Charland, Allen, Brooks, and Brown,

regularly participate in interstate discussions

and also serve as officers of multistate

organizations. Student Loan Ombudsman

McEvoy announced his departure from OFR in

FY 2023 and would be replaced by Director

of Legislation Amy Hennen who assumed the

role as acting Student Loan Ombudsman. As

Student Loan Ombudsman she engaged in

significant outreach and discussions with other

state and federal student loan organizations,

agencies and ombuds offices. All in all, OFR

staff increases the Office’s effectiveness when

they participate in and coordinate with other

state and federal agencies and organizations.

The State Collection Agency Licensing Board

again operated with full membership as it

gained two new members in Ms. Traci Rezvani

who joined the Board in the role of a consumer

representative and Mr. Shawn Kennedy who

joined the Board in the role of an industry

representative.

The Office took a number of steps to meet

our engagement goal including, continuing to

meet with consumer advocates in large and

small group settings, holding over 40 outreach

events, issuing 15 advisories on various topics,

and adding the foreclosure information that we

make available on our website to the State’s

Open Data Portal. The Office continued to

be supportive of and worked closely with

the Maryland Department of Housing and

Community Development on its Homeowner

Assistance Fund, and ongoing foreclosure

prevention initiatives. The Office held its third

annual “Regulatory Highlights” webinar, a

live-streamed event for regulated industries

and interested consumer groups, during which

OFR staff and leadership provided legislative,

supervisory, and enforcement updates. As

noted above and in her separate report,

Ombudsman McEvoy and Acting Student

Loan Ombudsman Hennen also undertook

a number of meetings and actions, including

providing consumers with the opportunity

for video meetings and engaging with the

Maryland Center for Collegiate Financial

Page 14 of 84

Financial Regulation Annual Report 2023

Wellness to inform borrowers of changes to federal payment and

waiver programs. In sum, those actions and the others detailed in this

report are all part of OFR’s commitment to stay connected to and

engaged with the public and key constituents. Finally, I continued

to be a member of the Maryland Financial Education and Capability

Commission.

The Office’s Licensing Unit again processed over 20,000 license

applications during the fiscal year. That accomplishment was made

possible by the hard work and dedication of the Licensing Unit staff.

Mortgage lenders/servicers, money service business, and consumer

credit companies that are licensed by the Office are subject to

periodic examinations to ensure that they are sound and operating

according to law. Those examinations are carried out by OFR’s

examiners from the Mortgage Supervision and Money Services

and Consumer Credit Supervision Units. Members of these staffs

distinguished themselves not only by the volume of their work,

having completed over 200 examinations of licensed entities, but

also by the quality of their work as leaders and/or participated in

multiple multi-state examinations, and some examiners lent their

expertise to the state system by providing training and or

IT knowledge.

The Office’s Consumer Services Unit continued to resolve

consumer complaints and finalized the implementation of the new

State Examination System (SES). The SES, which is also used by

the financial services supervisory unit to conduct examinations, is an

integral piece of state financial regulators’ networked supervisory

strategy. While it saw a 19% increase in complaint volume, OFR’s

Consumer Services staff was able to successfully recover $125,425

for Maryland consumers.

The States’ banks and credit unions performed well during the

fiscal year despite the headwinds caused by the continuing

increase in interest rates and the liquidity scare that arose in the

early Spring of 2023. As in recent past years, the vast majority

of Maryland’s state-chartered institutions were controlling risks,

were well managed, capable of withstanding business fluctuations,

and operating in substantial compliance with applicable laws and

regulations. However, as explained in the Depository Supervision

section of this report, that conclusion was not one that would’ve

been anticipated in the Spring of 2023 when the confidence in the

nation’s banking system suffered a serious blow upon the sudden

failure of two large, regional banks from California and New York.

Those failures caused significant distress to the country’s banking

system and OFR and other state and federal regulators worked

diligently during that period to continuously monitor institutions’ and

market conditions, implement new programs to enhance institutions’

liquidity, and review the circumstances that lead to the failures

to guide future policy. Fortunately, Maryland and its consumers,

businesses and financial institutions avoided serious repercussions

from the failures. Maryland’s financial institutions continued providing

uninterrupted financial services to their customers and by and large

they experienced satisfactory financial results, ending the fiscal year

in a fundamentally sound condition. Overall, it was a stressful time.

I would like to commend OFR’s depository staff for their hard work

during long days and thank the Maryland Bankers Association,the

MD|DC Credit Union Association, and their receptive members for

their cooperation and the coordination they provided to OFR and

other regulators.

Internally, OFR worked diligently to fill vacancies and to provide its

staff with the modern technology they need to ensure that the Office

operates efficiently and effectively and remains

a leader among state regulators. The Office

increased the amount of its budget allocated to

employee training and development and saw

employees take advantage of the opportunities

that were offered.

Looking to FY 2024, the Office again undertook

a structured strategic planning process that saw

it following Governor Moore’s directive to be a

State agency that supports the goal of “leaving

no Marylander behind.” To that end, and

working with Labor Secretary Wu, the Office

adopted FY 2024 goals that are as follows:

1. Protect Maryland consumers from financial

harm and educate them to make informed

financial decisions.

2. Modernize Maryland’s financial regulatory

system to adapt to rapid change and to be

efficient and effective for all stakeholders

through the use of technology and data.

3. Promote an equitable and inclusive financial

system that leaves no Marylander behind

and fosters broader participation by low to

moderate income communities and small

businesses in the financial system and state

economy.

4. Enhance employee engagement and

empower employees to execute with

excellence.

5. Strengthen the Office’s collaboration with

sister state regulators and other Maryland

agencies, to create a system that is

networked, transparent, and excellent.

In closing, I am honored to have had the

privilege of serving as Maryland’s Commissioner

of Financial Regulation for the past six years.

I am thankful to Governor Moore and Labor

Secretary Wu for giving me the opportunity

to continue serving in that capacity and look

forward to working with them, Maryland’s

legislators, OFR’s staff, and its stakeholders as

we all strive to protect Maryland’s consumers

and generally improve its consumer financial

services sector.

Antonio P. “Tony” Salazar

Commissioner of Financial Regulation,

State of Maryland

Annual Report

Fiscal Year Ended

June 30, 2023

Page 15 of 84

Financial Regulation Annual Report 2023

FISCAL YEAR 2023

Consumer Recoveries and Penalties Assessed: The Office collected a total of $358,539 in combined monetary

recoveries for Maryland consumers and civil penalties against companies and/or individuals that were identified to have

violated various State laws and/or regulations.

Equity and Access: The Office collaborated with Governor Moore to gain passage of the Access to Banking Act, a

new law that seeks to encourage financial institutions to retain and grow access to banking services in low-to-moderate

income communities.

Legislation: Three bills initiated by the Office in the 2023 General Assembly session became law.

Regulation: The Office finalized changes to the regulations for Foreclosure Procedures for Residential Property. The new

regulations provide clarity regarding the Commissioner’s authority to address violations of law or regulation, the rights of

homeowners, and the responsibilities of mortgage services.

Depository Institutions: Maryland-chartered banks’ total assets increased by 5.38% to $49.7 billion and Maryland-

chartered credit unions’ total assets increased by 2.5% to $8 billion.

Licensing: The Office licensed or registered 20,313 individuals and businesses, and collected $40,300 in penalties due to

prior unlicensed activity.

Financial Services Supervision: The Office completed 184 examinations of mortgage and money transmission business.

Mortgage Supervision assessed $208,375 in monetary recoveries for Maryland consumers from violations identified

during mortgage examinations.

Consumer Services: The Office was successful in recovering restitution payments of $125,425 for Maryland consumers

through the investigation and resolution of consumer complaints.

Enforcement: The Office assessed $27,840 in monetary recoveries for Maryland consumers and collected $40,162 in

penalties from a credit service business for unlawful practices associated with mortgage loan modification consulting

services.

Outreach and Education: The Office’s Outreach Unit organized or participated in 42 events, conferences, and stakeholder

meetings.

Data and Reporting: The Office implemented a process for monthly postings of foreclosure data on the Maryland Open

Data Portal.

Student Loan Ombudsman: The Ombudsman began offering video chat appointments for student loan borrowers and

presented to four different stakeholder groups.

HIGHLIGHTS

Page 16 of 84

Financial Regulation Annual Report 2023

EQUITY AND ACCESS TO

As part of the Office’s consumer protection and regulatory

mandate, OFR seeks to promote principles and practices that

are designed to ensure that Maryland’s financial services sector

operates equitably and that all Marylanders have access to safe

and well-regulated financial services.

Use of Data

In FY 2023, the Office started to utilize data and statistics in new

ways to better understand the demographics of banking, lending

and foreclosure in Maryland and to identify patterns indicating

potential disparities or inequities. For example, mortgage and

foreclosure data may reveal redlining, reverse redlining, or other

discriminatory or disparate lending practices.

Sources of data include the FDIC’s Unbanked and Underbanked

Survey, Federal Financial Institutions Examination Council (FFIEC)

branch location data, Home Mortgage Disclosure Act lending

data, Mortgage Bankers Association mortgage lending and

default data (obtained through the Conference of State Bank

Supervisors), and call reports from supervised

companies. The Office also analyzes consumer

complaint data from its own Consumer Services

Unit, as well as from federal agencies, including

the Consumer Financial Protection Bureau,

Federal Trade Commission, and Office of Federal

Student Aid in the U.S. Department of Education.

Additionally, OFR conducts routine analyses of

address-level data from the Maryland Foreclosure

Registration System, with a focus on geographic

and demographic data obtained from the U.S.

Census Bureau and the Maryland Department of

Information Technology.

The Office’s analyses are primarily used for

decision-making, strategic planning, policy

development, and for various supervisory

activities, such as examinations and investigations.

The Office shares statewide foreclosure data

FINANCIAL SERVICES

Page 17 of 84

Financial Regulation Annual Report 2023

publicly on the Foreclosure Data Tracker page of OFR’s

website and data aggregated by county and zip code is

shared on the Maryland Open Data Portal. In FY 2024,

OFR will explore if additional aggregated data or reports

can be made available to a wider audience in an effort

to improve transparency and better inform the public

and interested stakeholders, including policymakers and

researchers.

Planning and Policy

The Office’s FY 2024 strategic plan, developed in the

last quarter of FY 2023, included several objectives

and tactics focused around issues of equity and access.

As an example, one of OFR’s goals in the next fiscal

year is to “promote an equitable and inclusive financial

system that leaves no Marylander behind and fosters

broader participation by low-to-moderate income (LMI)

communities and small businesses in the financial

system and state economy.”

The 2021 FDIC National Survey of Unbanked and

Underbanked Households shows the importance of

policies that promote equitable access to safe and

affordable deposit accounts at insured institutions.

• Approximately 5.9 million or 4.5% of U.S. households

identified as “unbanked”, meaning that no one in the

household had a checking or savings account at a

bank or credit union. In Maryland, 5% of households

were unbanked.

• Differences in unbanked rates between Black and

White households and between Hispanic and White

households were present at every income level. In

Maryland, 10.6% of Black households were unbanked

as opposed to 1.8% of White households.

• The most cited reason from survey respondents for

why they do not have a bank account was “Don’t

have enough money to meet minimum balance

requirements”.

The Office is exploring strategies to improve accessibility

of banking services in Maryland’s LMI communities and

expanding outreach efforts, particularly to vulnerable

populations who often face systemic discrimination

or may not have the opportunity to access financial

education resources.

Additionally, enforcement priorities were revised in FY

2023 to explicitly state that ensuring equal access to

lending opportunities, particularly mortgage lending, for

everyone regardless of race or national origin is a focus

for the Office. This includes investigations of complaints

alleging violations of the Equal Credit Opportunity Act,

Fair Housing Act, and other anti-discrimination laws.

Enforcement priorities are described in greater detail in

the Enforcement section of this report.

In the FY 2023 General Assembly Session, OFR assisted

with passage of Governor Moore’s Access to Banking

Act. The Act promotes the growth of financial services in

LMI communities through the use of assessment credits

to Maryland state-chartered banks and credit unions

that operate branches in LMI communities; and through

the establishment of a venture fund to invest in financial

innovations that develop opportunities for banking

institutions and credit unions to better serve the needs of

LMI communities. More information about this Act is in the

Message from the Commissioner, Legislative Summary,

and Depository Supervision sections of this report.

Page 18 of 84

Financial Regulation Annual Report 2023

MONETARY RECOVERIES FOR CONSUMERS AND

Consumer Recoveries

Total Consumer Recoveries FY 2023

$174,663

Monetary recoveries for consumers result from

OFR’s commitment to protect the public from

economic harm caused by companies or individuals

providing financial services in Maryland. During FY

2023, the Office recovered and provided $174,663 in

restitution to consumers across all Units.

Total Consumer Recoveries Fiscal Year 2023

$174,663

Penalties Assessed

Total Penalties Assessed FY 2023

$183,876

During FY 2023, OFR investigated or examined

companies and/or individuals that were identified

to have violated various State laws and/or

regulations, and as a result of those investigations

and examinations, collected assessed penalties of

$183,876.

Total Penalties Assessed Fiscal Year 2023

$183,876

TOTAL

$358,539

PENALTIES ASSESSED

Financial Regulation Annual Report 2023 Page 19 of 84

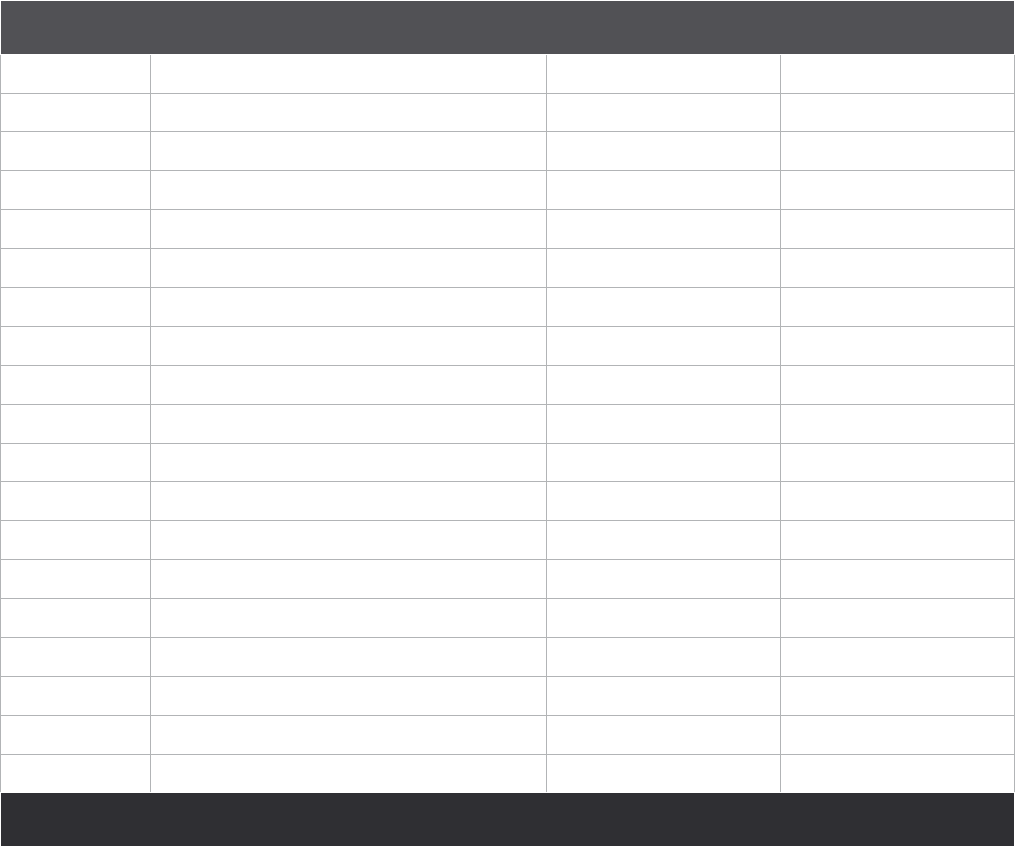

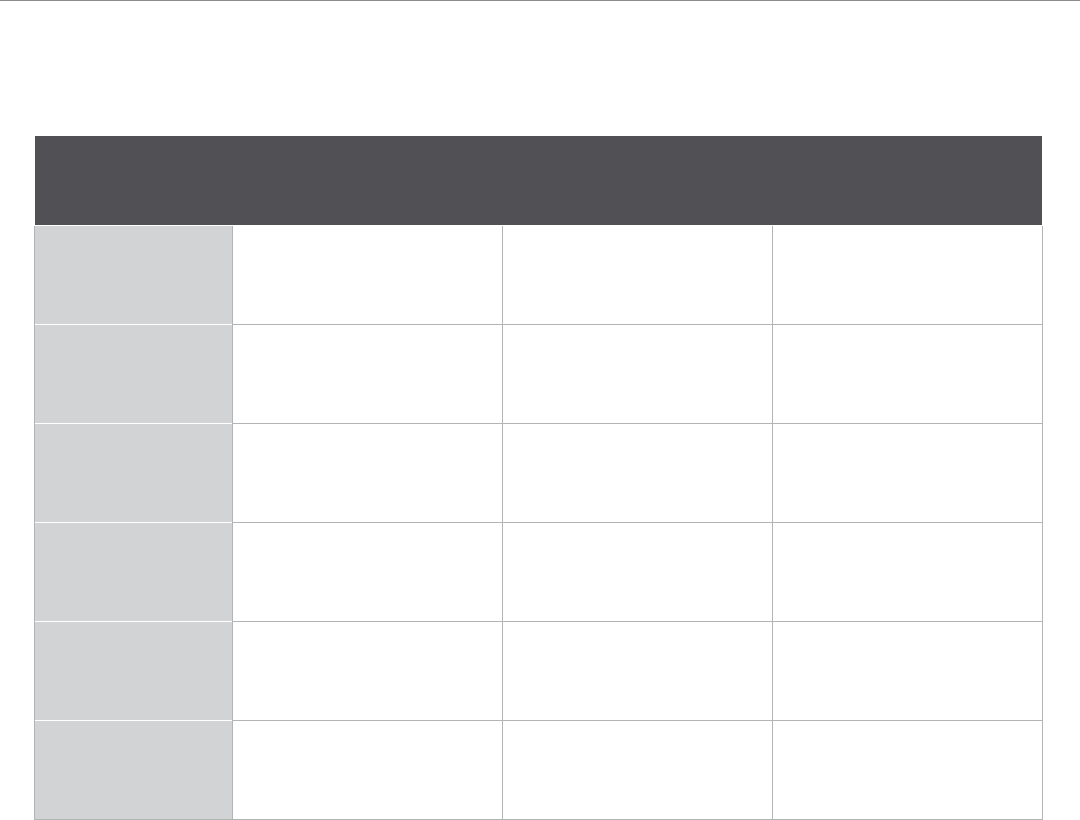

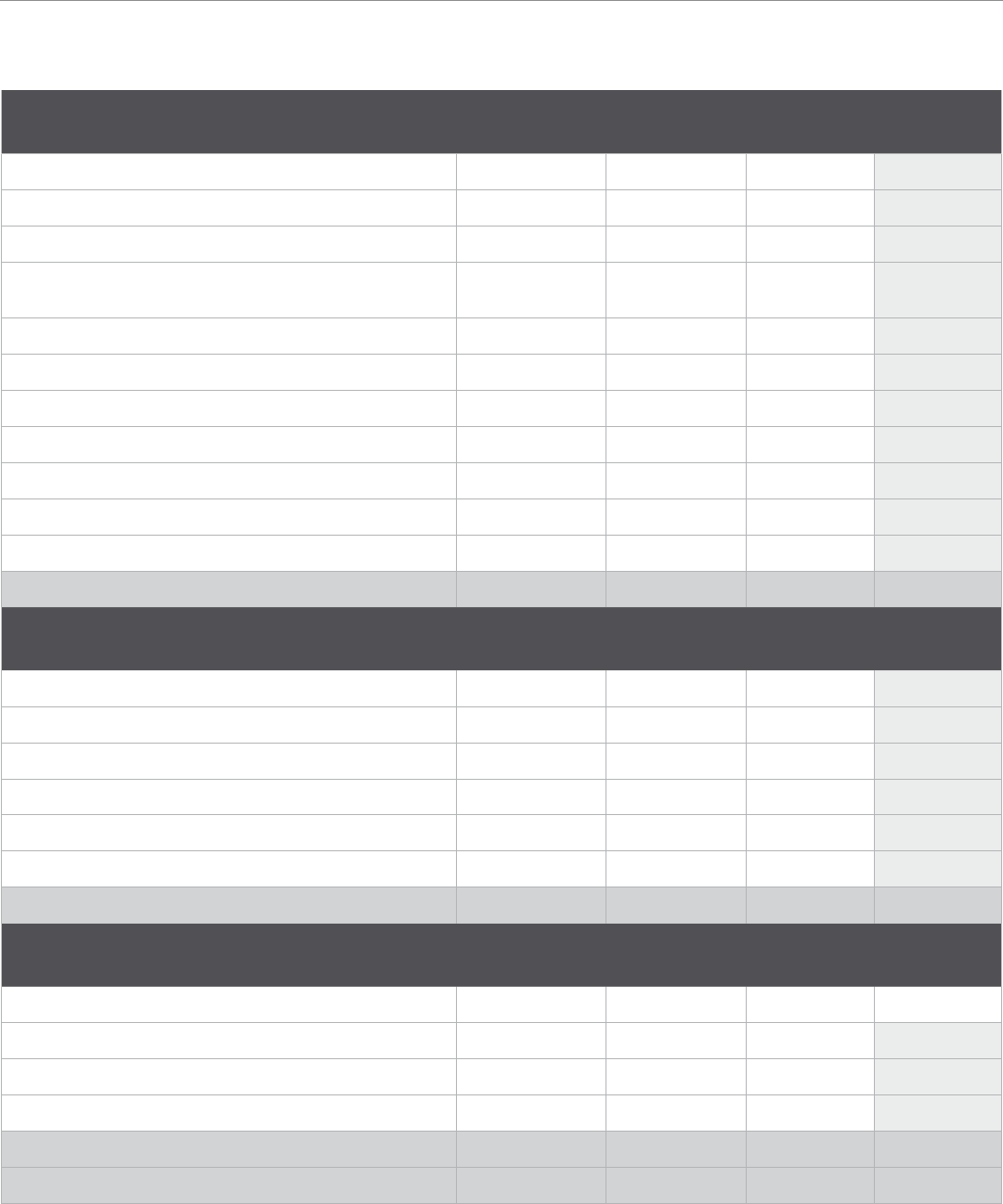

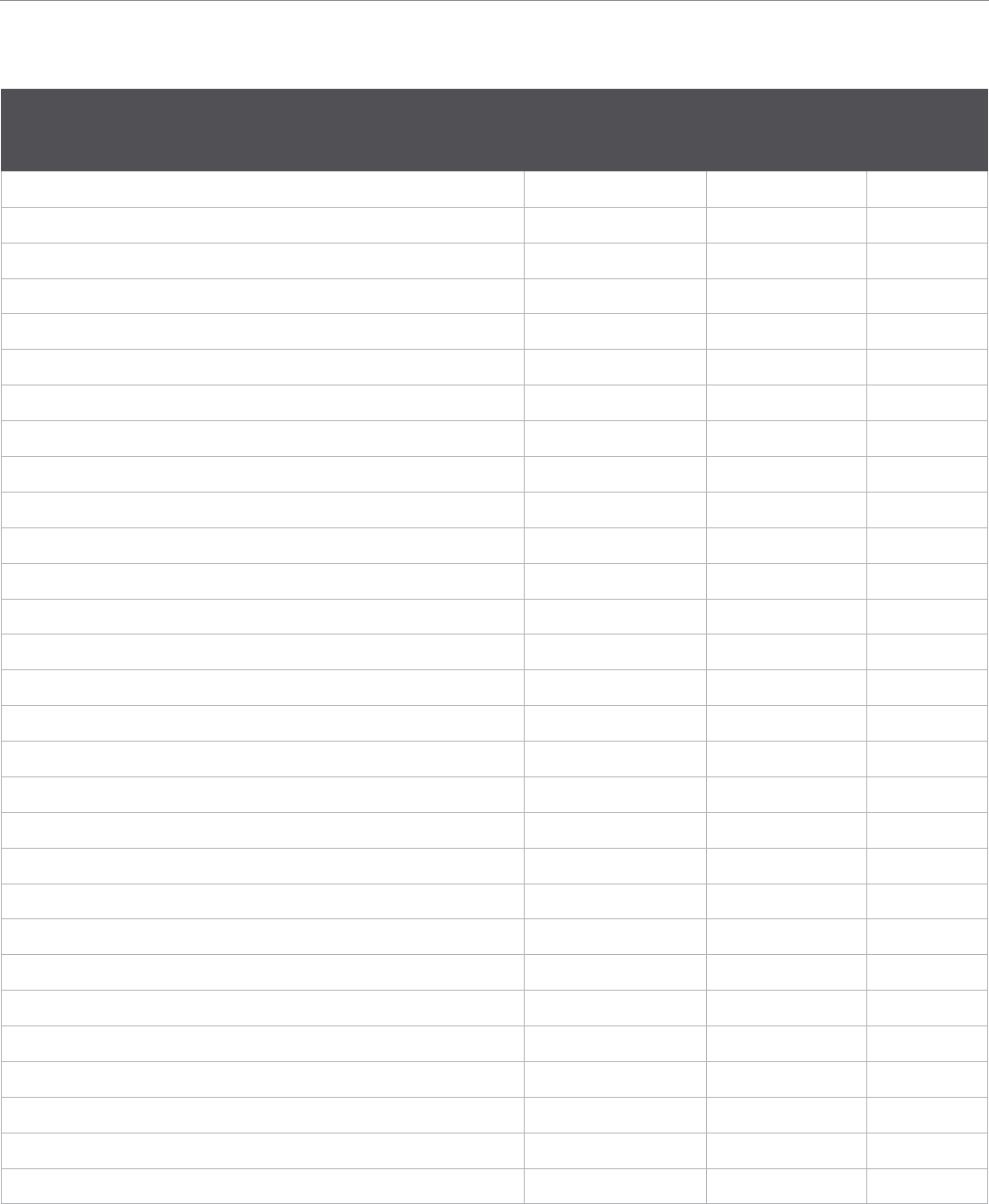

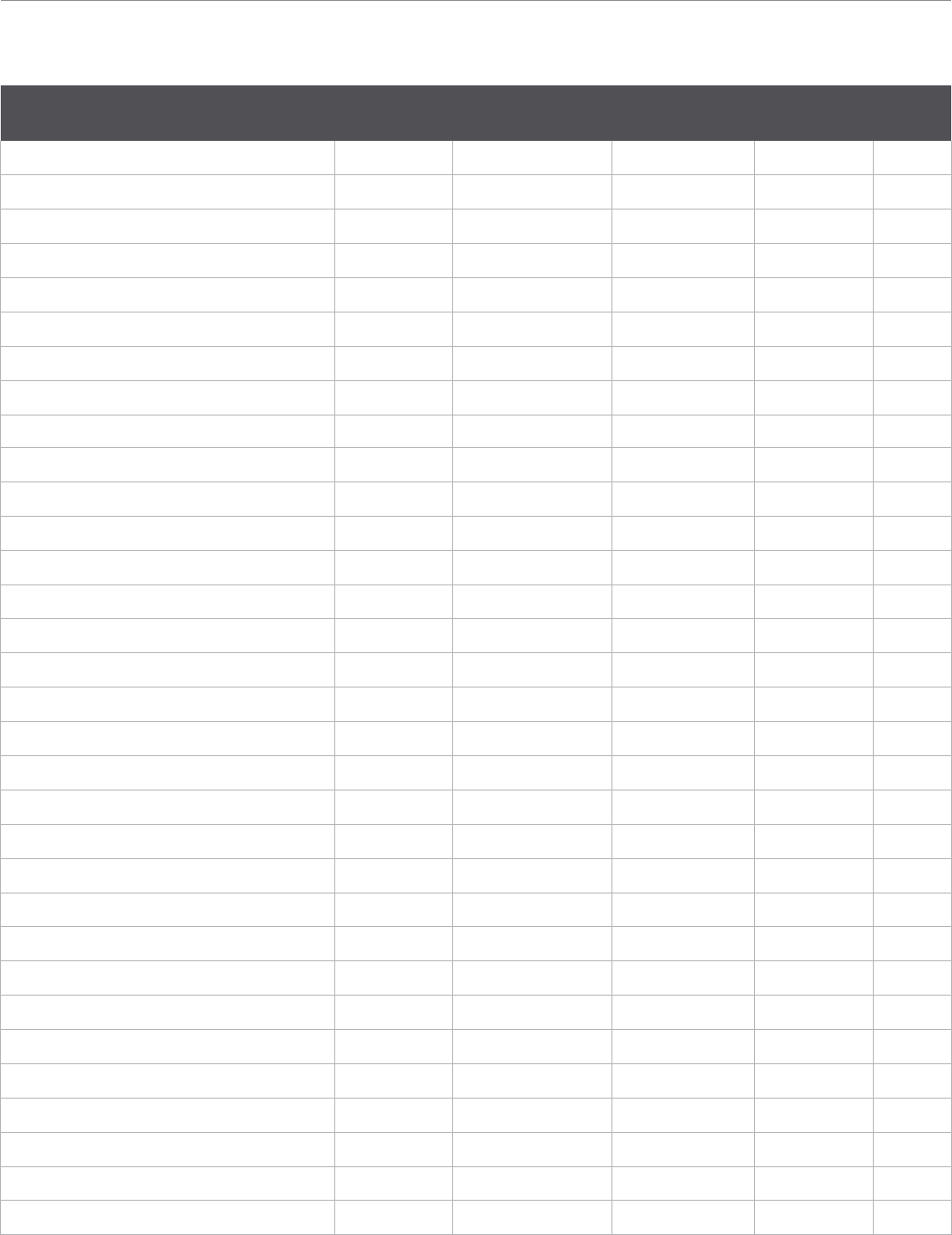

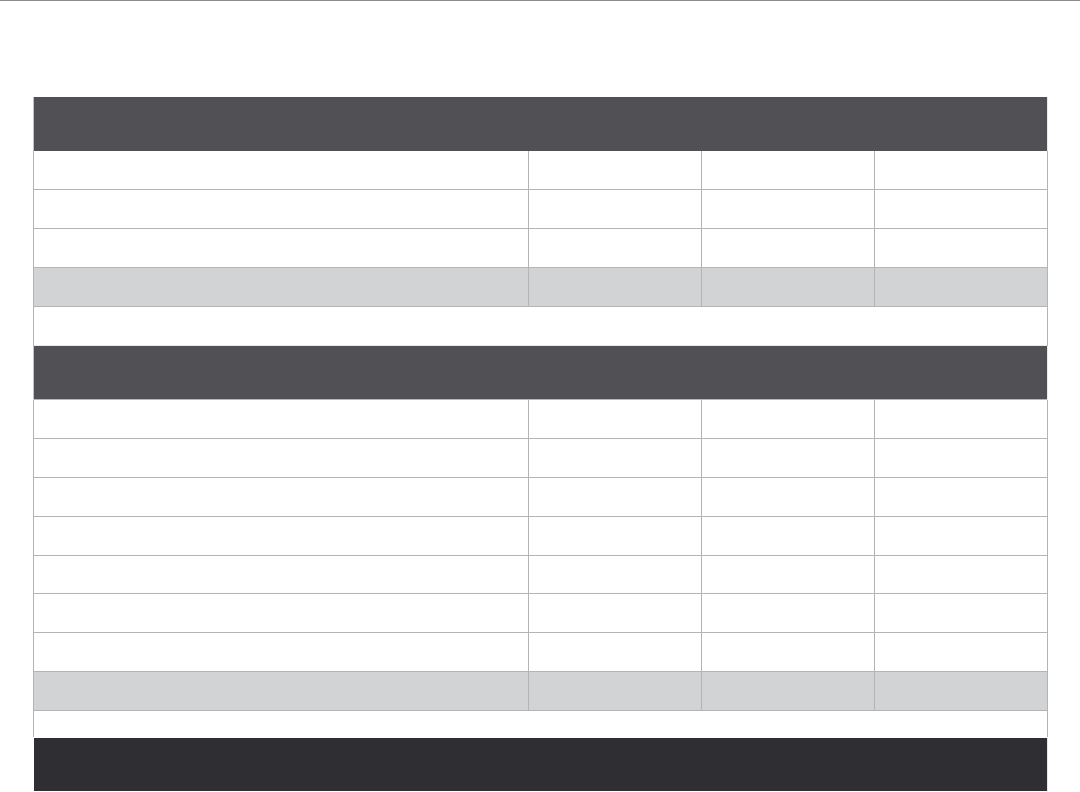

License No. License Type No. of Penalties Instances of Restitution

1 Sales Finance 3

2 Consumer Loan 1 2

3 Installment Loan

4 Collection Agency 11 4

6 Mortgage Lender 74 23

8 Credit Reporting Agency 1

9 Check Casher

10 Bank 3

11 Credit Union 16

12 Money Transmitter 12

14 Debt Management Service Provider

15 Debt Settlement Service Provider

19 Licensed Check Casher

26 Mortgage Originators

28 Credit Services Business 1 1

29 Check Casher Registration

34 Registered Exempt Collection Agency

36 Exempt Mortgage Lender - Registered

N/A Other 2 28

TOTAL 89 93

MONETARY RECOVERIES

Below is a breakout of the number of penalties assessed and instances of restitution by type of license during FY 2023.

Page 20 of 84

Financial Regulation Annual Report 2023

LEGISLATIVE AND REGULATORY

Legislative Summary

The Maryland 2023 General Assembly

adjourned on April 10th, concluding a

successful legislative session. The Office

proposed three bills, worked closely

with the Governor’s Office on another

bill, and provided technical support on

other legislation focused on improving

the Office’s efficiency, clarifying

Maryland laws under its jurisdiction,

enhancing consumer protections, and

promoting a safe and healthy financial

services industry. Those bills and other

notable legislation that passed during

the 2023 session of the Maryland

legislature are described below.

HB 379/SB 929: Commissioner of

Financial Regulation - Name and

Organization of Office

Effective date: July 1, 2023

This law, initiated by the Commissioner,

changes the name of the Office under

the Commissioner of Financial Regulation

in the Maryland Department of Labor

to the “Office of Financial Regulation’’.

The law also establishes a new Deputy

Commissioner position that is for financial

services licensing and supervision (aka,

non-depository activities).

HB 686: Financial Regulation -

Modernizing Licensing of Non-

Depository Institutions and Elimination

of Branch License Requirements

Effective date: July 1, 2023

This law, initiated by the Commissioner,

eliminates the requirements for collection

agencies and certain non-depository

financial institutions to maintain separate

licenses for their branch locations. It

authorizes them to conduct business at

multiple licensed locations under a single

license. Financial service businesses will

pay one licensing fee that will include

all branches plus an assessment the

amount of which is determined by the

Commissioner each year. The assessment

will be based on actual costs to regulate

the business, including risk and size. All

licensed locations will be covered under

a business’s bonding requirements to

ensure consumer protection. The Office

intends to draft and issue appropriate

implementing regulations.

HB 1150: Commercial Law and

Financial Institutions - Credit Regulation

- Shared Appreciation Agreements

Effective date: July 1, 2023

This law, initiated by the Commissioner,

makes certain that shared appreciation

agreements are subject to the Maryland

Mortgage Lender Law and other

provisions of law that regulate certain

loans of single extensions of closed end

credit and revolving credit plans. The

Office will adopt regulations regarding

the enforcement of and compliance with

provisions of law that regulate shared

appreciation agreements.

HB 548/SB 550: Financial Regulation -

Maryland Community Investment

Venture Fund - Establishment

(Access to Banking Act)

Effective date: July 1, 2023

This law, initiated by the Governor,

establishes the Maryland Community

Investment Venture Fund. The Fund is

to be established by the Commissioner

with seed money from the Depository

Special Fund. Under the new law,

Maryland-chartered banks and credit

unions with branches in LMI census

tracts will be able to apply for credits

toward the annual assessment amount.

The law encourages banks and credit

unions to deposit the value of the credit

into the venture fund and permits the

Commissioner to match some or all

these funds. The Venture Fund will

be used to provide seed funding to

small businesses developing new

access to capital for under-resourced

small businesses located in LMI

communities.

SB 516: Cannabis Reform

Effective date: upon enactment

This law establishes a regulatory and

licensing system for adult-use cannabis

and requires the Administration,

by July 1 2023, to convert medical

cannabis licenses to licenses to

operate a medical and adult-use

cannabis business. The Office will

monitor the banking sector for any

issues with banks and credit unions

that chose to provide banking services

to licensed cannabis businesses.

HB 384: Income Tax - Student Loan

Debt Relief Tax Credit - Alterations

Effective date: July 1, 2023

This law increases the total amount of

credits against the State income tax

that the Maryland Higher Education

Commission may approve in a

taxable year for student loan debts.

Additionally, it extends from two years

to three years, the period of time that

an individual who claims the credit

has to prove that they used the credit

to repay the individual’s student loan

debt. The Student Loan Ombudsman

within OFR will monitor and advise

Marylanders on this issue.

HB 680: Institutions of Higher

Education - Transcripts - Prohibition

on Punitive Measures Related to

Student Debt

Effective date: July 1, 2023

This law prohibits an institution of

higher education from refusing to

provide a current or former student

with a transcript or taking other

punitive measures regarding a

student’s transcript request because

the student owes a debt to the

institution of higher education. The

Student Loan Ombudsman within

OFR will monitor this issue.

Changing Legal Environment and Innovative Regulatory Advancements

SUMMARY

Financial Regulation Annual Report 2023 Page 21 of 84

LEGISLATIVE & REGULATORY

ADVANCEMENTS

HB 913: Financial Institutions - Student Financing

Companies - Required Registration and Reporting

Effective date: October 1, 2023

This law requires student financing companies to register

with the Commissioner of Financial Regulation before

providing services in the State; requires a student

financing company to renew its registration on an annual

basis; authorizes the Commissioner to adopt registration

procedures for student financing companies, which

may include certain fees; and requires student financing

companies to annually report certain information, to be

made publicly accessible on a certain website, to the

Commissioner beginning March 15, 2024. The Office

will create a registry with NMLS for student financing

companies to register and a portal for these companies to

provide the required information. The Office will post this

information on its website and report it in the Student Loan

Ombudsman Annual Report.

SB 106: Courts - Judgments - Exemptions

From Execution

Effective date: October 1, 2023

This law exempts up to $500 in a deposit account or

other account of a judgment debtor held by a depository

institution from execution on the judgment without an

election by the debtor to exempt the money. Further, it

establishes procedures a depository institution is required

to follow on receipt of a writ of garnishment or other levy

or attachment under certain circumstances. The Office will

monitor licensees who may be impacted by this legislation.

HB 127: District Court - Small Claims - Enforcement

of Money Judgments

Effective date: October 1, 2023

This law prohibits the District Court, in aid of enforcement

or execution of a money judgment resulting from a certain

small claim action, from ordering the appearance of an

individual for an examination or ordering an individual to

answer interrogatories. The Office will monitor licensees

who may be impacted by this legislation.

Regulatory Summary

The Office successfully pursued two noteworthy regulatory

initiatives during the fiscal year:

Foreclosure Procedures for Residential Property

Effective date: March 1, 2023

On December 16, 2022, the Commissioner adopted

amendments to Regulations in COMAR 09.03.12

Foreclosure Procedures for Residential Property. The

changes to the regulation were made final in 49:26 Md.

R. 1078-1079 (December 16, 2023). The amendments

were issued in order to harmonize certain regulations

that are inconsistent or contradictory as a result of recent

changes within the Maryland Annotated Code, update and

generally improve existing requirements and forms within

the mediation process, and update provisions regarding

the Commissioner’s authority to address violations of

law or regulation. The changes are intended to reduce

procedural gaps within the foreclosure mediation process

and to provide greater clarity regarding the rights and

responsibilities of mortgage servicers and consumers.

Money Transmission

Effective date: FY 2024

On February 24, 2023, the Commissioner proposed

amendments to Regulations in COMAR 09.03.14 Money

Transmitters. The proposed changes implement provisions

of the CSBS Model Money Transmission Modernization Act

and are intended to further harmonize Maryland law with

other states and provide clarity and certainty regarding

the responsibilities of money transmitters and the rights of

consumers. The changes are anticipated to be effective in

FY 2024.

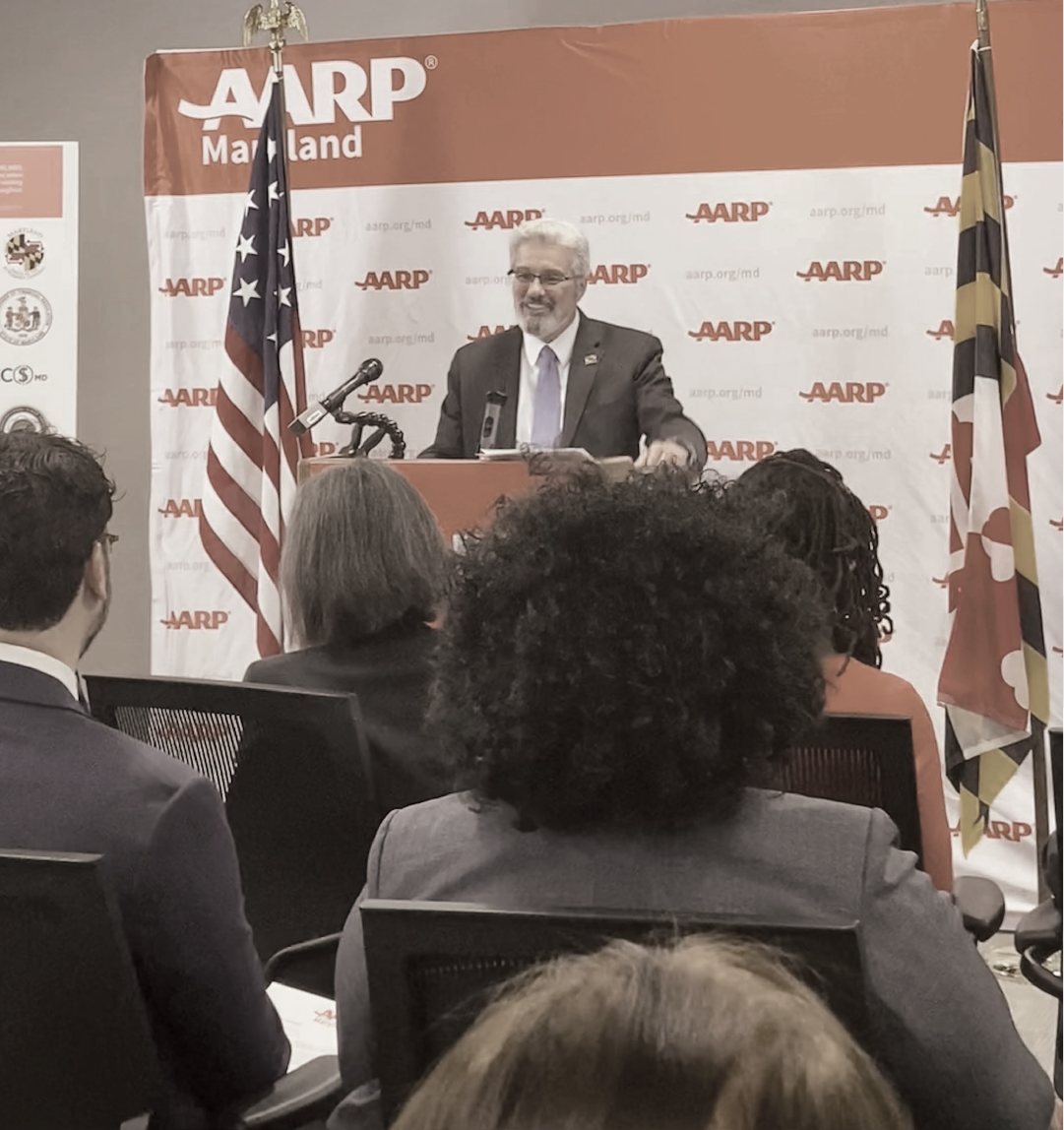

Commissioner Salazar and Director of Legislative Response at the bill signing

for HB379/SB 929; with Maryland’s Senate President, Governor Moore,

Secretary Wu, and Speaker of the House of Delegates.

$

Financial Regulation Annual Report 2023 Page 22 of 84

Updates on the

Office’s regulatory

and consumer-focused

activities over

the past fiscal year.

INDUSTRY SUPERVISION &

CONSUMER PROTECTION

Page 23 of 84

Financial Regulation Annual Report 2023

DEPOSITORY

The Office’s Depository Unit regulates and supervises a total of

33 Maryland state-chartered institutions as of the end of FY 2023.

Of those institutions, 22 are banks, seven are credit unions, and

four are non-depository trust companies. The Depository Unit also

supervised the American Share Insurance Corporation (ASI), an

Ohio-based, private provider of deposit insurance for credit unions.

The Depository Unit is overseen by the Assistant Commissioner for

Depository Supervision and as of the end of FY 2023, the Unit had

14 bank examiners on staff, of which five are examiners-in-charge.

Overall, Maryland-chartered financial institutions performed well in

FY 2023. Maryland’s banks and credit unions reported solid financial

condition, sound asset quality, ample capital augmentation, and

sufficient liquidity in the face of challenging market conditions.

In the Spring of 2023, liquidity became a focus for all regulatory

agencies because of two large regional bank failures in California

and New York. In response to the upheaval in the banking sector

precipitated by the failures, OFR risk-assessed its chartered

institutions and began focusing specifically on institutions’ immediate

liquidity sources, uninsured deposits exposure, non-bank financial

institution deposits concentrations, and investment portfolios. The

Office implemented daily liquidity monitoring of high-risk institutions,

as well as daily meetings with management of the institutions, and

it maintained regular contact with federal bank regulators. The

Federal Reserve created the Bank Term Funding Program (BTFP)

which offered loans of up to one year in length to banks and credit

unions pledging collateral eligible for purchase by the Federal

Reserve Banks in open market operations such as U.S. Treasuries,

U.S. agency securities, and U.S. agency mortgage-backed securities.

The BTFP served as an additional source of immediate liquidity

at reasonable terms. The Office contacted all Maryland-chartered

institutions and strongly encouraged them to establish a funding line

with the Federal Reserve discount window so they could have an

alternative funding source should the need arise. While Maryland’s

financial institutions did not face the liquidity pressures that affected

many of the nation’s financial institutions in the Spring, the majority

of the State’s banks and some credit unions took advantage of the

program and established BTFP funding lines, and some even used

their new funding line due to the attractive rates that were offered.

Overall, Maryland-chartered banks and credit unions strengthened

their liquidity positions and enhanced internal monitoring of liquidity

following the turmoil of Spring 2023.

Facing moderate loan demand throughout FY

2023, Maryland-chartered institutions were

fortunate to enjoy excess liquidity which was

primarily reallocated to securities investment

portfolios that generated higher returns given

the increasing rate environment. FY 2023 saw

Maryland state-chartered banks and credit

unions adopting the “current expected credit

losses” (CECL) methodology for estimating

their allowances for credit losses. The adoption

of CECL led to higher provision expenses

despite asset quality generally remaining good.

In April 2023, OFR gave a “Climate Change

Risks and Maryland Financial Institutions”

presentation to the management teams and

Boards of Directors of the State’s banks and

credit unions. The purpose of the presentation

was to provide guidance about OFR’s current

expectations regarding the management of the

various risks posed by climate change and on

the establishment of governance structures to

manage those risks. The Office’s climate change

presentation was well attended and banks

and credit unions were provided with learning

and discussion points regarding the effects

of climate change risk on Maryland financial

institutions. The Office continues to participate

in the CSBS District I Task Force, led by the

New York Department of Finance, on climate

change risk to community banks.

The Office continued its practice of issuing

regulatory advisories and guidance, responding

to inquiries from bankers, and monitoring loan

activity, concentrations, liquidity, information

technology and cybersecurity oversight, and

compliance with the Bank Secrecy Act/Anti-

Money Laundering.

Supervising Maryland State-Chartered Banks, Credit Unions, and Trust Companies

SUPERVISION

Page 24 of 84

Financial Regulation Annual Report 2023

DEPOSITORY

Bank Supervision

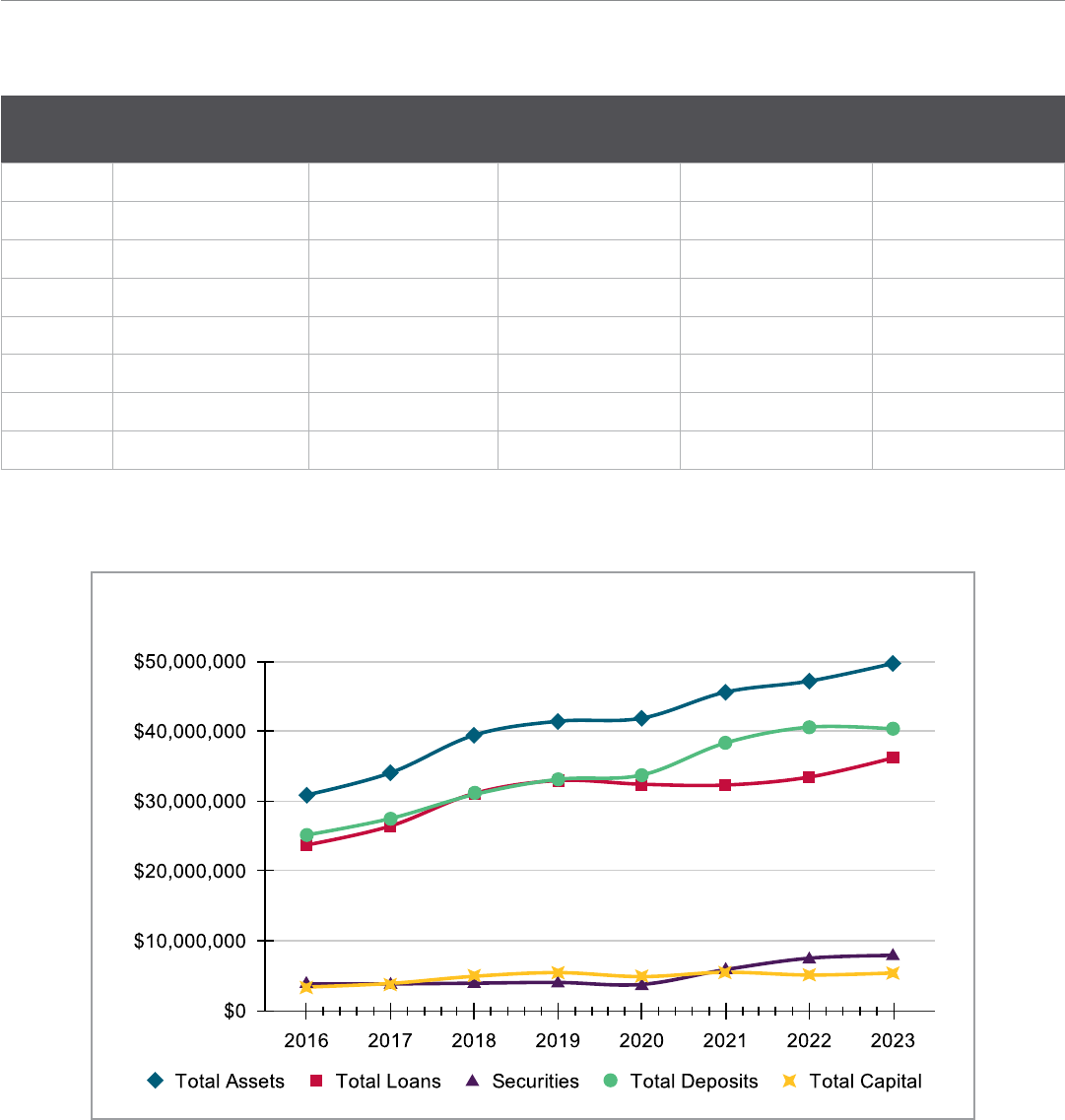

In FY 2023, only one Maryland-chartered bank was acquired by an

out-of-state bank. The reduction in the number of banks supervised

by OFR, from FY 2022 to FY 2023, is a considerable improvement

from the loss of five banks over FY 2021 to FY 2022. Management at

many Maryland-chartered banks remained focused on reevaluating

their resources, maintaining sound asset quality, and enhancing

earning performance during challenging economic times. Despite the

loss of one bank, total assets held by the remaining 22 banks under

OFR’s supervision grew by $2.5 billion, or 5.38%, from $47.1 billion to

$49.7 billion in FY 2023.

Aggregate capital in Maryland-chartered banks increased

approximately 6.10% from $5.1 billion to $5.4 billion over FY 2023.

The capital increased despite a slight decline in earnings caused

by an increase in provisions for loan and lease losses and reduced

noninterest income. Bank holding companies continued to be

successful in raising capital during FY 2023 and downstreamed equity

into their bank subsidiaries. The combined reported capital leverage

ratio of 10.77% represented a modest increase and can be generally

attributed to capital accretion outpacing asset growth. All Maryland-

chartered banks ended FY 2023 well-capitalized.

Even with the loss of one bank, Maryland-chartered banks’ aggregate

level of net loans and leases increased by 8.40%, from $33.8 billion

to $36.7 billion. Their level of investment securities also increased by

$403 million, or 5.38%, to $7.9 billion in FY 2023. Maryland-chartered

banks continued to serve their commercial customers with the Small

Business Administration’s Paycheck Protection Program (PPP) loans,

loan forgiveness, and loan modifications.

Asset quality performance indices for

Maryland-chartered banks were again positive

in FY 2023. With most institutions experiencing

loan growth, the level of non-performing assets

to total assets increased from the multi-year

low of 0.37% reported at FYE 2022 to a

higher level of 0.59% in FY 2023. That level

represents a continued historically low level

of non-performing assets, and of the non-

performing assets, other real estate owned

assets decreased significantly by 35.29% to

$11.0 million over the same period as banks

were able to liquidate the properties they

held in the face of the increasing interest rate

environment. Net charge-offs to total loans

and leases increased but ended the fiscal

year at a manageable, and also extremely low

level, of 0.12%, representing an increase over

the historically low 0.02% reported at FYE

2022. The overall level of banks’ allowance for

loan and lease losses increased by 24.46%, to

$450.8 million, which is commensurate with the

growth in loan portfolios and the adoption of

the CECL allowance calculation methodology.

Based upon these asset quality performance

indices, Maryland-chartered banks entered FY

2024 poised to focus on asset growth and net

operating income.

Supervising Maryland State-Chartered Banks, Credit Unions, and Trust Companies

SUPERVISION

Page 25 of 84

Financial Regulation Annual Report 2023

Toward the end of FY 2022, the Federal

Reserve’s Federal Open Market Committee

(FOMC) began raising interest rates in an effort

to curtail inflation. Maryland’s banks retained

good liquidity and they took advantage of the

higher interest rates by growing their investment

portfolios. The increased rates enabled Maryland

banks to generate increased interest income

on their loan portfolios and invested funds. The

FOMC continued its increasing interest rate

strategy throughout FY 2023 and into FY 2024.

For the State’s banks, earnings performance

experienced a continuing negative trend during

FY 2023. The banks’ average return on assets

(ROA) decreased from 1.49% ending FY 2022

to 1.35% at the end of FY 2023. As described

above, much of the decrease is attributed to

increased provisions for loan and lease losses

over FY 2022, which outweighed the increase

in the banks’ collective net interest margin.

Specifically, Maryland-chartered banks’ net

interest income was bolstered by the increasing

interest rate environment which improved their

collective net interest margin to 3.66% at the end

of FY 2023, from 3.53% at the end of FY 2022.

Safety and soundness examinations continued

to be full scope although examination activities

were modified in FY 2023 to accommodate

remotely conducted examinations and to

reduce the burden on Maryland bankers. During

examinations and off-site monitoring, OFR

assessed banks’ capital levels, asset quality

performance indices and trends, management

oversight, earnings levels and trends, liquidity

and funds management, sensitivity to interest

rate risk, and risk management practices, with

an emphasis on liquidity levels, liquidity risk

management, liquidity concentrations, uninsured

deposits and fundings sources, commercial

real estate lending, and lending concentrations.

Information technology, cybersecurity, and the

Bank Secrecy Act/Anti-Money Laundering

reviews and assessments also continued as

essential components of examinations.

Worthy of note is the fact that OFR issued

only one formal enforcement action due to

Bank Secrecy Act concerns during FY 2023.

To the extent that OFR had other concerns

with a small number of specific institutions, it

addressed them through enhanced regulatory

supervision and oversight, employing a variety

of means including regular teleconference calls,

visitations and targeted examinations, meetings

with management and Boards of Directors, off-

site reviews and monitoring, and informal enforcement actions.

As a result of their organic growth, Maryland has two state-chartered

banks each with over $10 billion in total assets and another four banks

each with assets over $1 billion. Banks over $10 billion in total assets

are required to comply with a variety of federal regulations that are

applicable to large, complex banking organizations. In addition, those

banks are subject to the examination and supervision authority of the

Consumer Financial Protection Bureau which examines institutions for

compliance with federal consumer financial laws.

Topics in the forefront of OFR’s work to continue into FY 2024 include

closely monitoring banks’ liquidity positions, asset quality, and servicing

practices related to information technology oversight, financial elder

abuse monitoring and prevention, and succession planning for both

management and Boards of Directors. Interest rate risk and liquidity risk

management will also continue to receive thorough attention throughout

FY 2024 as will compliance with the CECL reserve methodology and

the Bank Secrecy Act. Cannabis-related banking, which involves banking

related to marijuana and hemp products, gained attention in FY 2023,

and it is expected to remain a topic of interest as adult use marijuana

became legal in Maryland on July 1, 2023. The Office anticipates more

state-chartered banks will begin servicing cannabis-related businesses

in FY 2024.

Maryland-chartered banks have always had a significant impact on

the regional economy and they proved their significance during the

COVID-19 pandemic. The banking industry in Maryland continues to

serve its customers more efficiently; improve products, services, and

processes; and grow assets, and in some cases have partnered with

fintech companies to help in those efforts. Recognizing, however, that

there are gaps in the delivery and accessibility of banking services in

the State, and consistent with Governor Moore’s goal of establishing

Maryland as a state that leaves no one behind, in FY 2023 OFR began

planning implementation of the Access to Banking Act (House Bill 548)

in order to support and encourage industry efforts to ensure that banking

services and credit are offered equitably to all communities in the State.

The Office will remain in active dialogue with bank management teams

throughout the state and regularly seek out and participate in outreach

events sponsored by the Maryland Bankers Association, the Federal

Deposit Insurance Corporation, and Federal Reserve Bank. And, OFR

has and will continue to issue regulatory guidance when necessary, as

well as address institution-specific situations when they arise as part of

its mission to protect Marylanders through the operation of a modern

financial regulatory system that promotes respect for consumers,

safety and compliance, fair competition, responsible business

innovation, and a strong state economy.

Credit Union Supervision

The Office regulates and supervises seven Maryland-chartered credit

unions. Of the seven credit unions, the deposits of six are federally

insured through the National Credit Union Share Insurance Fund with

the deposits of the remaining credit union being privately insured by

ASI. Each of the credit unions received full scope safety and soundness

examinations during FY 2023. Those examinations were frequently

conducted via a hybrid approach with some work conducted remotely

and some work conducted onsite at the institution. As with the

Page 26 of 84

Financial Regulation Annual Report 2023

bank examinations, some examination activities were modified to

accommodate remote examination activity and to reduce the burden

on credit union management and staff. The Office supplemented

the examinations with quarterly, off-site monitoring and targeted

examinations as deemed necessary.

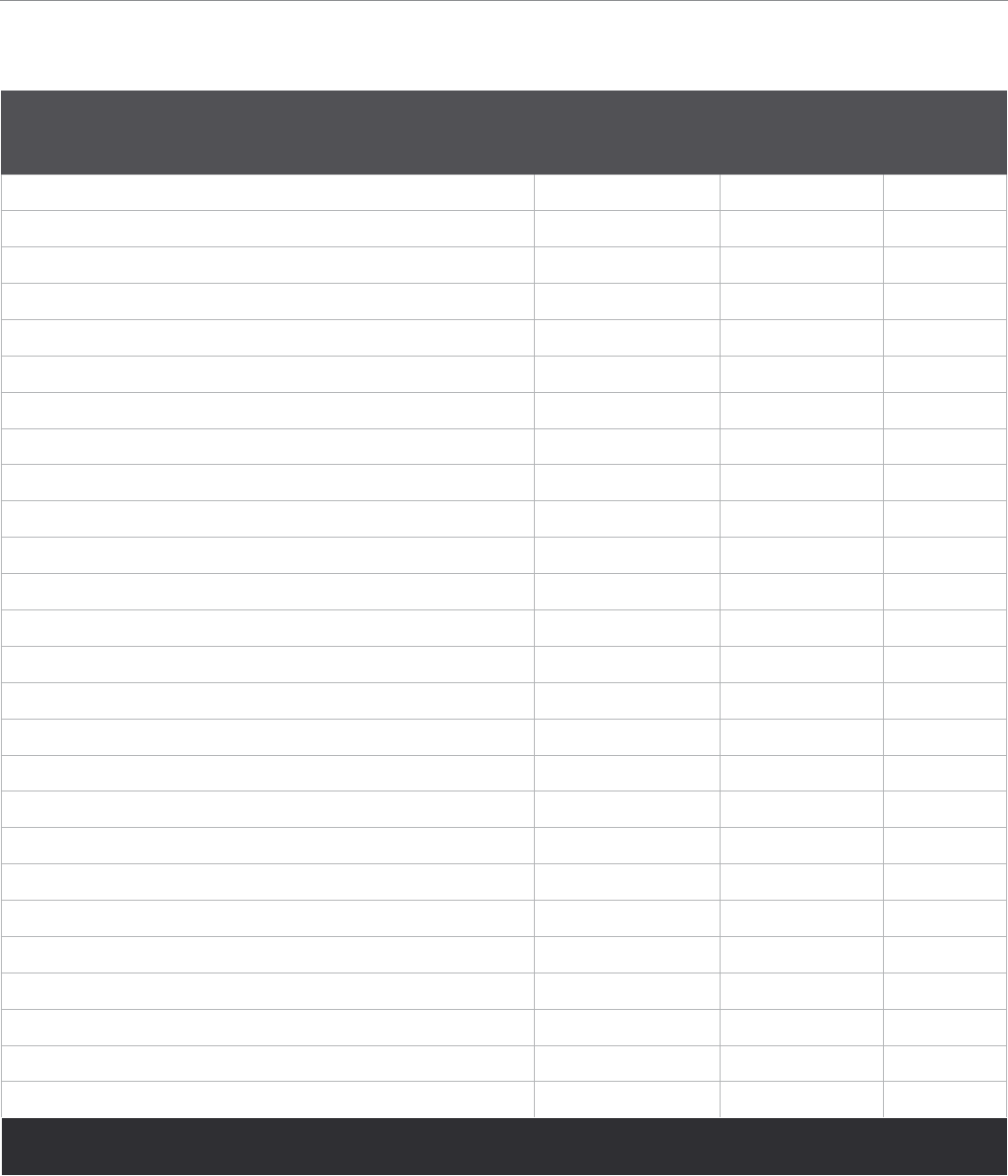

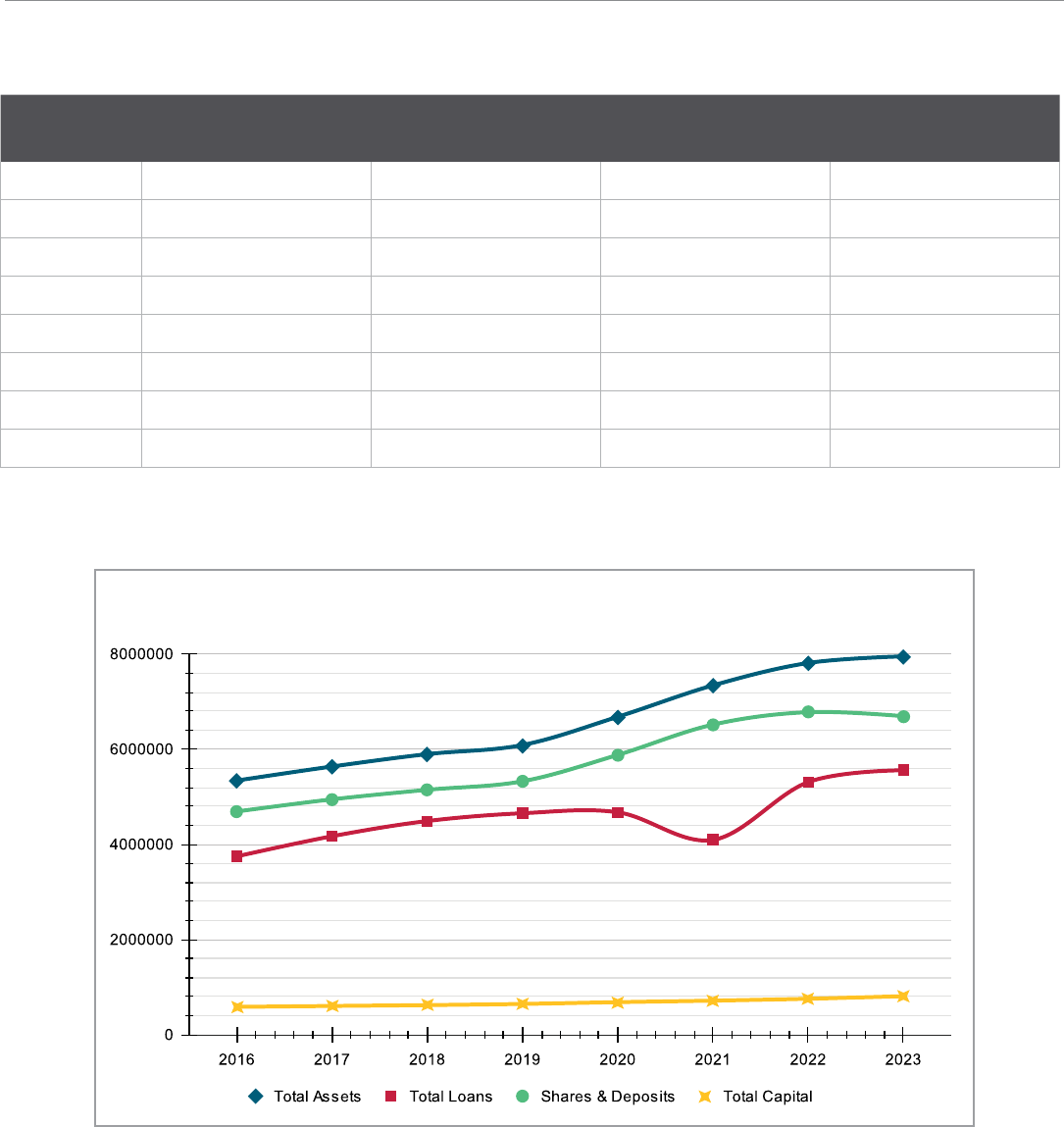

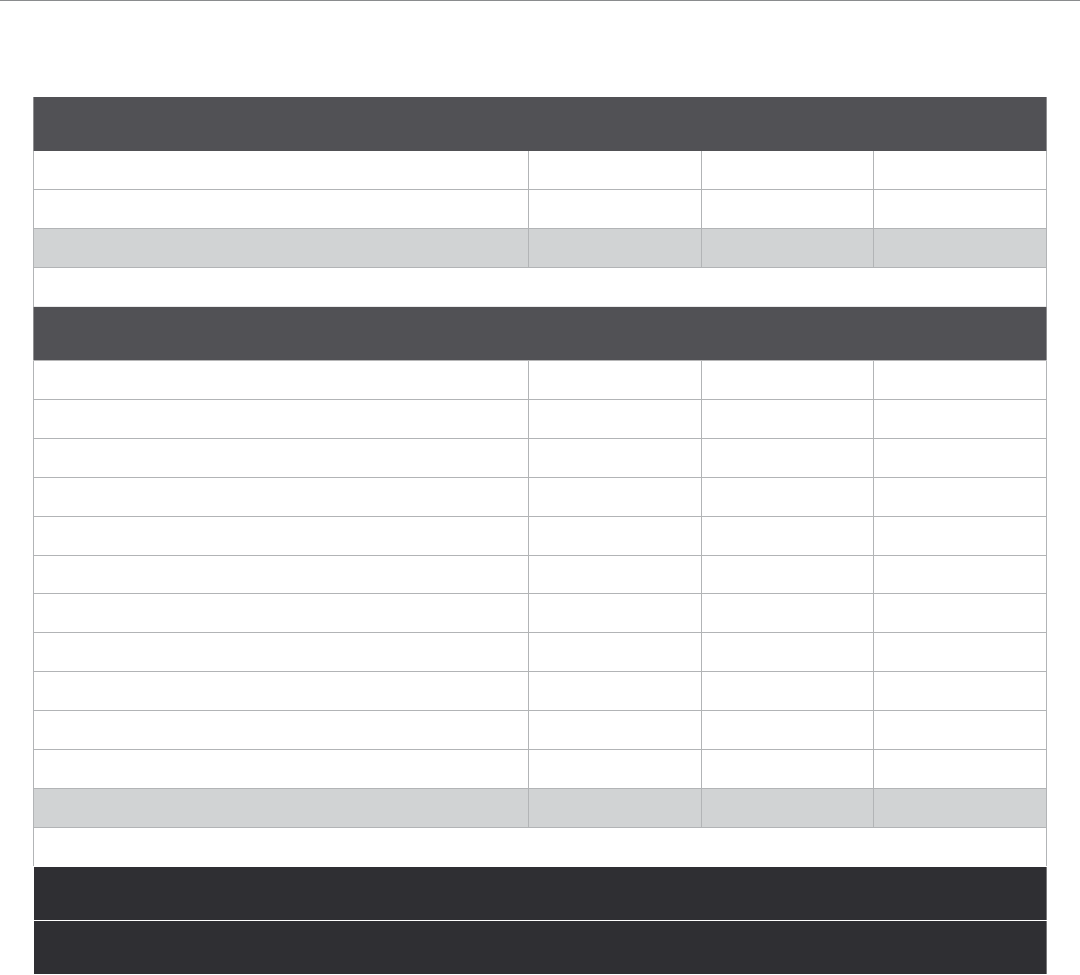

Overall, in FY 2023, the level of total assets held by Maryland-chartered

credit unions increased by 2.5% from $7.8 billion ending FY 2022 to

$8.0 billion ending FY 2023. Over the same period, total loan receivables

increased to $5.6 billion from $5.3 billion, investment and securities

declined from $1.7 billion to $1.4 billion, shares and deposits decreased

negligibly to $6.7 billion from $6.8 billion, and total capital increased

to $811.8 million from $757.5 million. Throughout FY 2023, Maryland-

chartered credit unions continued to serve their business members

with PPP loans, loan forgiveness, and loan modifications. Additionally,

the credit unions’ net worth increased from 9.70% of total assets to

10.21% of total assets, as capital accretion outpaced asset growth,

while their combined ROA increased considerably from 0.33% to 0.75%.

Much of the increase in their ROA was driven by the higher interest

rate environment that considerably improved their interest income.

Much as with the bank supervisory program, the focus of OFR’s work

in FY 2024 insofar as credit union supervision is concerned is to continue

close monitoring of credit unions’ liquidity, asset quality, cybersecurity

oversight, financial elder abuse monitoring and prevention, and

succession planning for management, directors, and Supervisory

Committee members. Interest rate risk, the CECL reserve methodology,

the Bank Secrecy Act/Anti-Money Laundering, and cannabis-related

banking, which includes banking related to marijuana and hemp

products, will also continue to receive attention throughout the 2024

fiscal year. Finally, OFR will be conducting follow-up on its 2023

climate change presentation and engaging with the state’s credit

unions to ensure they benefit from the Access to Banking Act

(House Bill 548) and that they participate in efforts to ensure that

financial services are offered equitably to all communities in the State.

Like Maryland’s banks, Maryland state-chartered credit unions also

benefited from a strong economy despite the Federal Reserve Bank

increasing interest rates, primarily in FY 2023 and continuing into FY

2024, in an effort to curtail inflation. Credit unions continued to serve

their membership and focused on increasing

membership and generating profitable assets.

The Office continues to be committed to

assisting credit union management with leading

their institutions while meeting the needs of

their membership. The Office has and will

continue to issue regulatory guidance when

necessary, and the Commissioner and staff

will remain in active dialogue with credit union

management and their Boards of Directors.

Also, OFR will continue to seek out and

participate in outreach events sponsored by

the MD|DC Credit Union Association and the

National Credit Union Administration (NCUA).

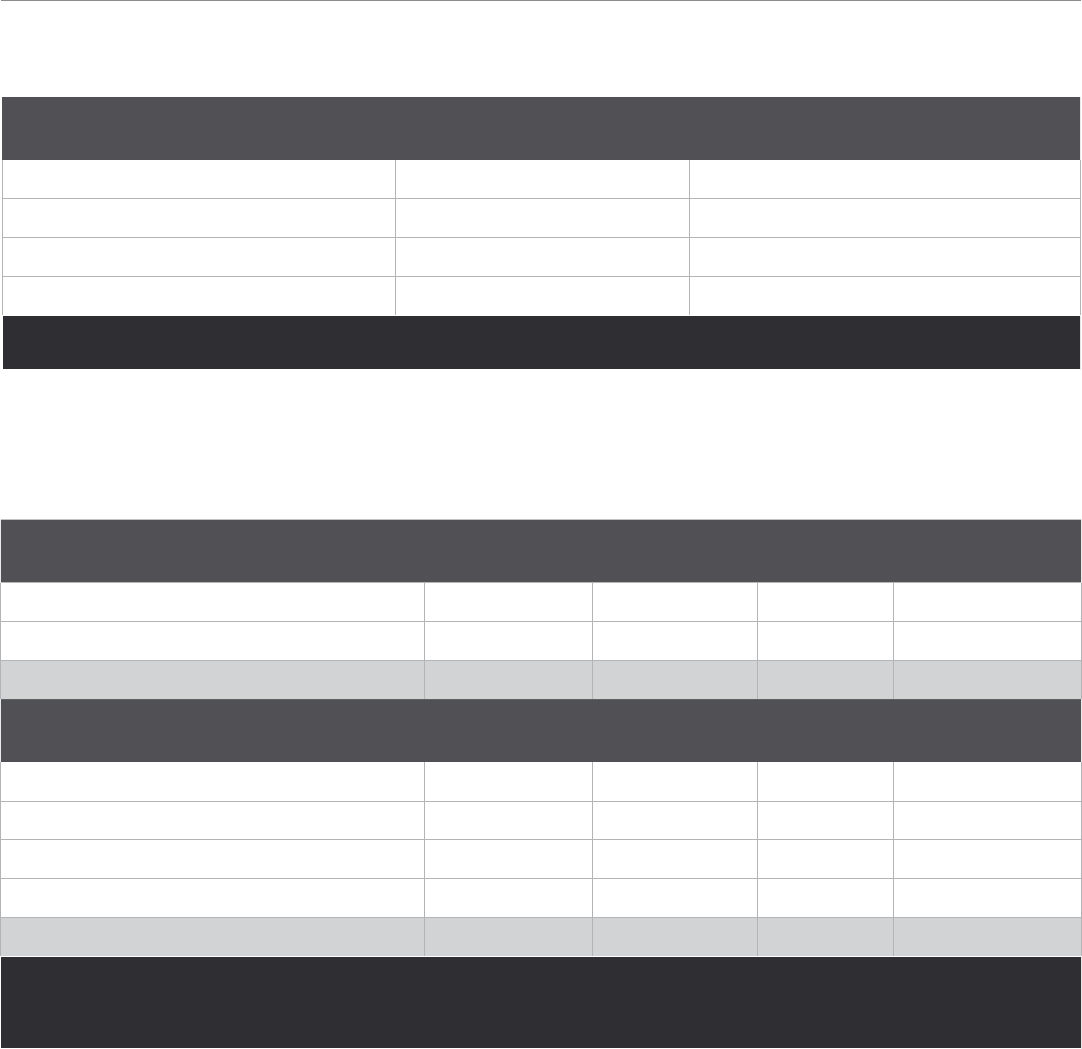

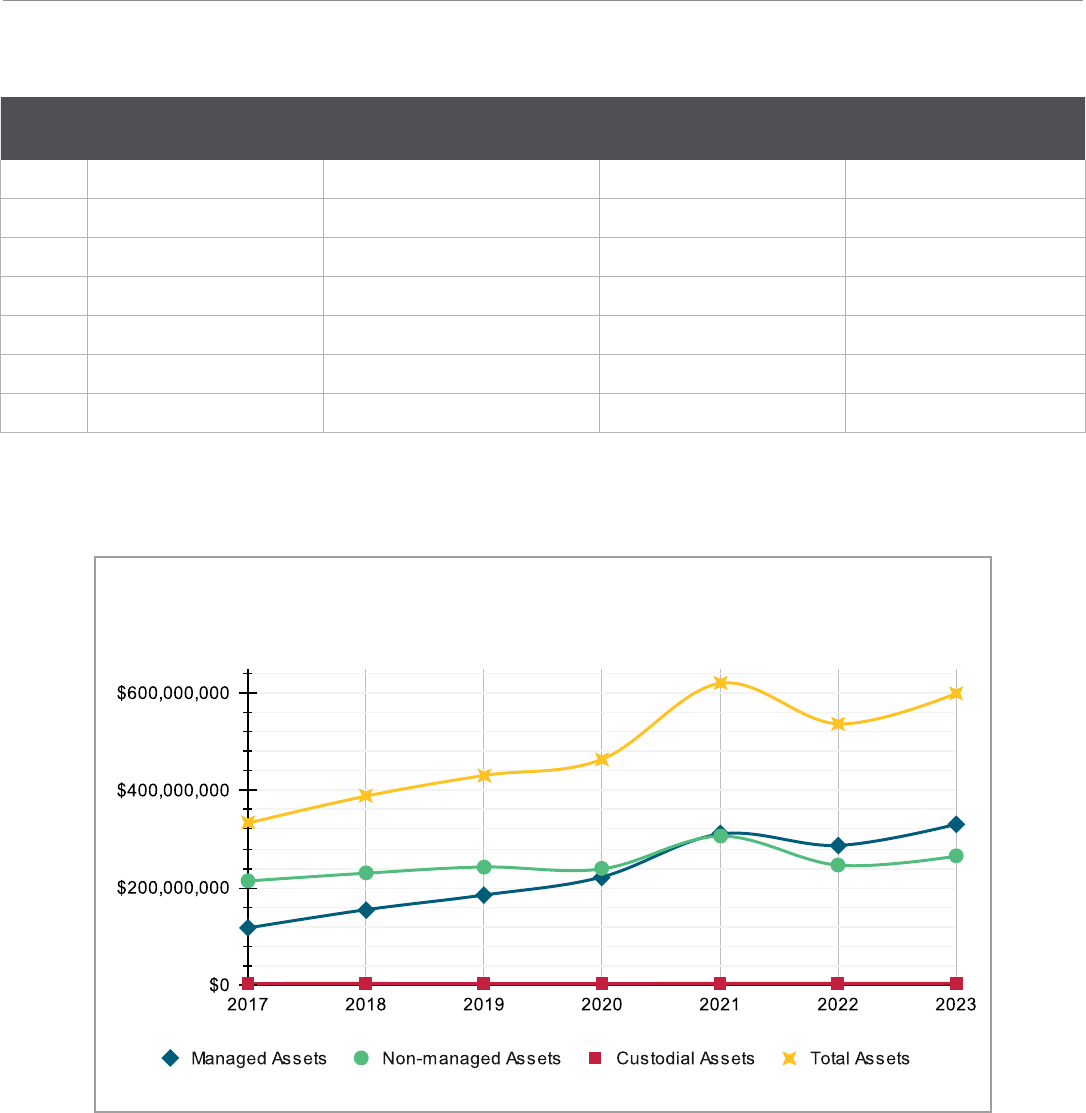

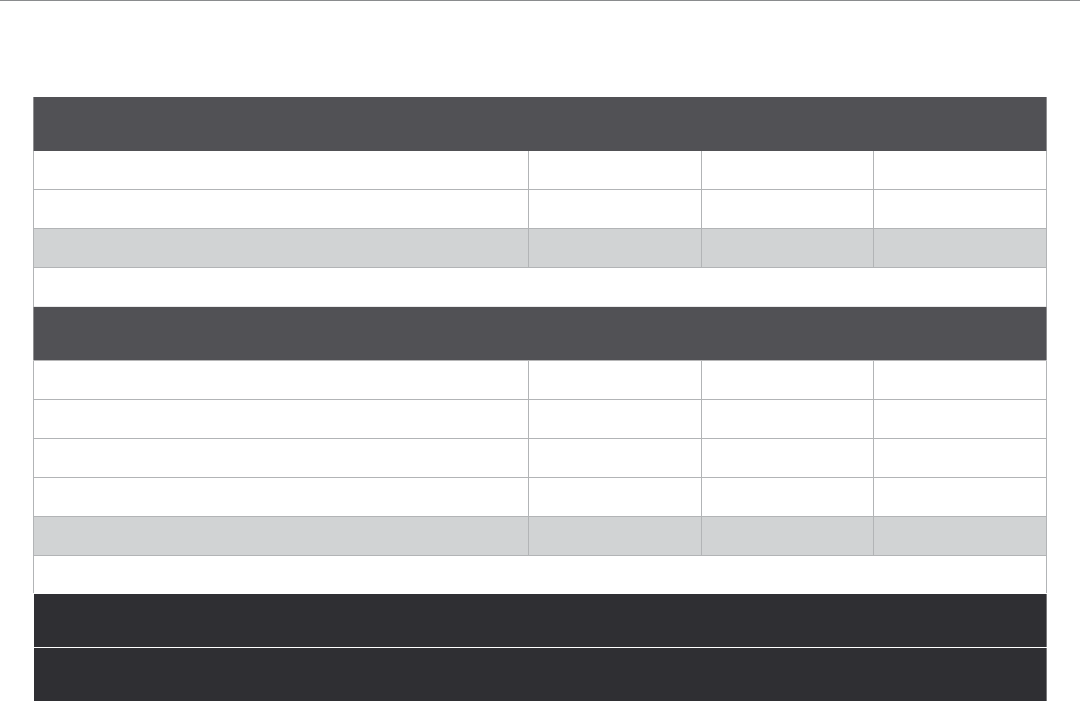

Non-Depository Trust Company

Supervision

Maryland’s four state-chartered non-depository

trust companies continued to perform effectively

throughout FY 2023. Trust company management

worked diligently to meet the needs of their

clients during uncertain domestic and global

times. Managed and non-managed assets

experienced strong growth with total assets-

under-management increasing to $596.2 billion

ending FY 2023 from $530.6 billion ending FY

2022. Trust companies generated net income

of $75.1 million during the first half of calendar

year 2023, which is up moderately from $73.9

million in net income generated during the first

half of calendar year 2022.

The trust companies anticipate additional growth

in FY 2024 and management will continue to

monitor volatility and economic conditions

in national and international bond and equity

markets, interest rates, and real estate markets.

Safety and soundness examinations of non-

depository trust companies are full scope

and have been conducted remotely since the

pandemic. The Office expects to conduct hybrid

examinations during FY 2024. Examiners’ focus

will remain on asset management, earnings,

capital, management, operations, internal

controls and audit, compliance, Bank Secrecy

Act/Anti-Money Laundering compliance,

information technology/cybersecurity

oversight, and succession planning.

Commissioner Salazaar and Secretary Wu at Financial Regulation

meeting April 2023.

Financial Regulation Annual Report 2023 Page 27 of 84

Page 28 of 84

Financial Regulation Annual Report 2023

DEPOSITORY

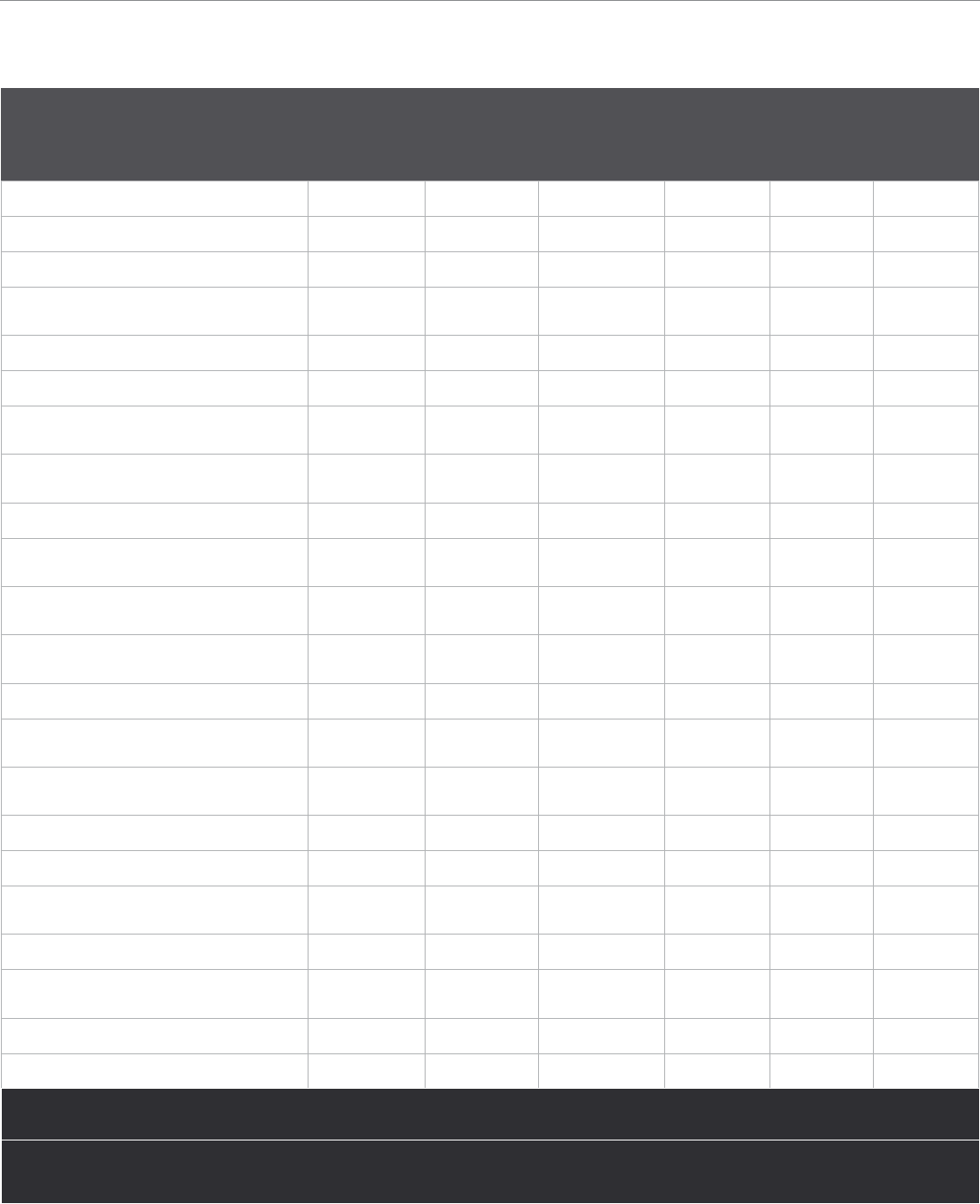

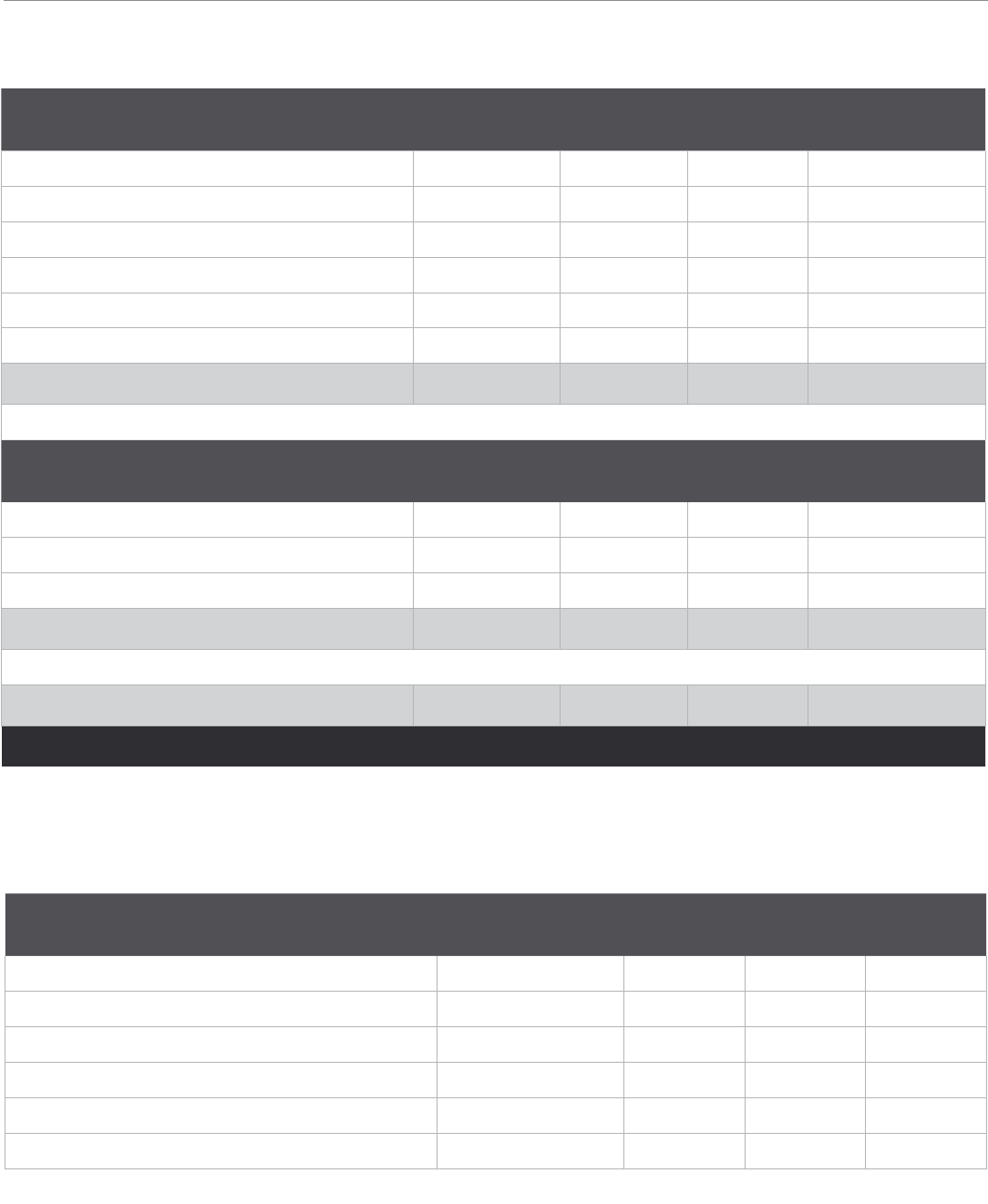

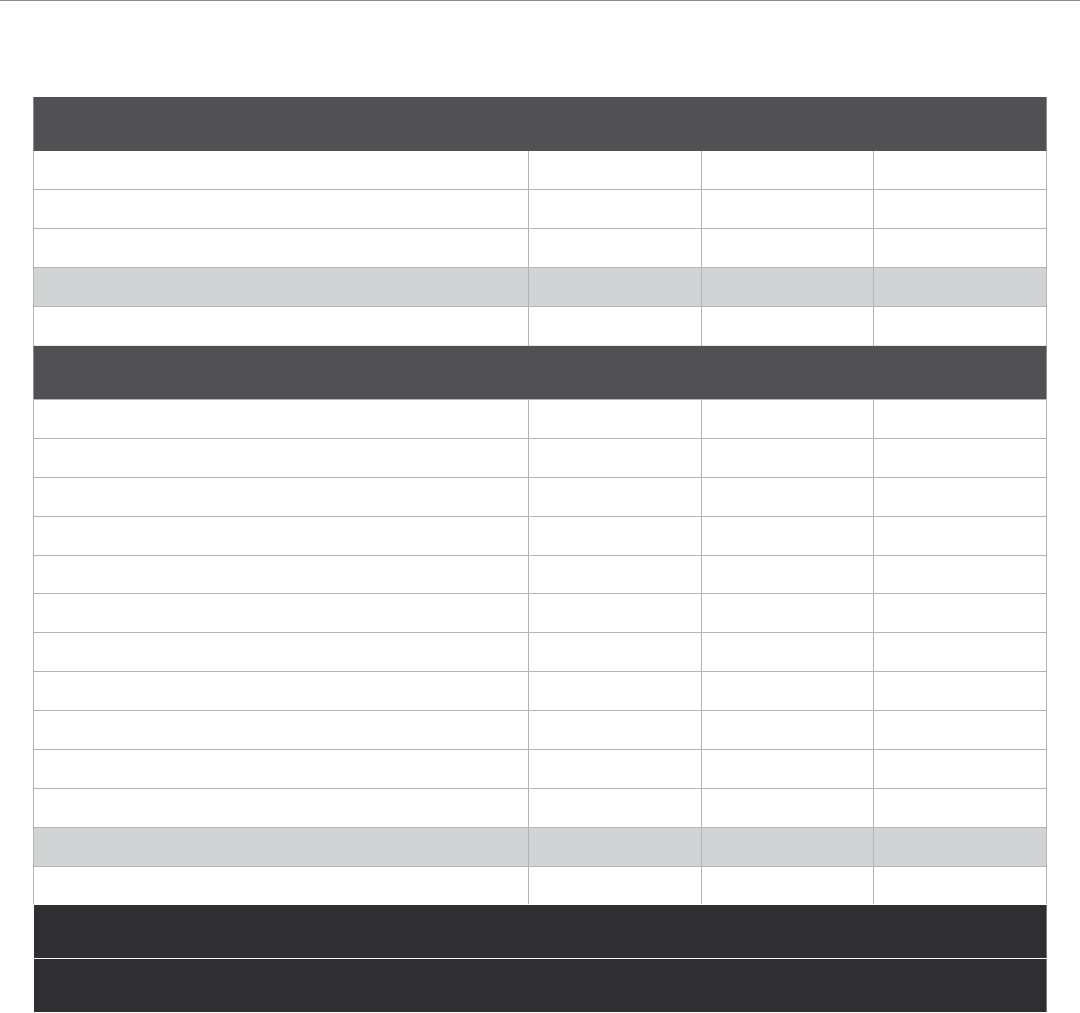

The Office began FY 2023 with regulatory responsibility for 23

banks with $47.142 billion in total assets, and ended FY 2023 with

responsibility for 22 banks with $49.677 billion in total assets, resulting

in an annual asset growth rate of 5.38%. While asset growth remained

steady over the past five years, the number of Maryland-chartered

banks has continued its decline. The 22 Maryland-chartered banks in

FY 2023 represent a 37.14% decrease from the 35 Maryland state-

chartered banks in FY 2018. The decrease from 23 to 22 Maryland-

chartered banks was due to the merger of a Maryland-chartered

bank into a bank chartered in West Virginia. Additionally, in FY 2023

OFR approved the merger of a Maryland-chartered bank into a

national bank headquartered in Maryland, however this merger did

not become effective until July 1, 2023. The completion of this merger

at the start of FY 2024 further reduces the number of Maryland-

chartered banks to 21.

While the number of Maryland-chartered banks continues to decrease,

the percentage of total bank assets held nationally as compared to

total bank assets held by Maryland-chartered banks continues to

increase, and bank consolidation has not adversely impacted the